LOS ANGELES — In an era when automotive luxury usually means the sleekest of sedans or crossovers, an entrepreneur here is offering a different kind of status vehicle, a rugged off-roader more at home fording the Ganges than crawling through the drive-thru at Wendy's.

Matt Perlman has made a business out of importing and refurbishing old Land Rover Defenders, the Jeep-type truck probably best known as the vehicle of choice for African safaris. It is a rugged, go-anywhere, easy-to-fix vehicle that is no longer sold in the U.S.

Nonetheless, Perlman says that since opening last year, his West Coast Defenders business has refurbished and sold more than 30 mid-1980s Defenders in the past year at prices from $95,000 to $110,000, depending on condition and body type. At any given moment, a bevy of the British vehicles are packed into the rear lot of his garage in this motoring metropolis' tony west side.

"Our main goal is to keep them as authentic as possible while bringing them into the 21st century," Perlman says.

After tracking down good prospects in Europe, Africa or Asia, Perlman goes through the Defender looking for anything that needs to be fixed or adding comforts based on what the new owners want — whether it's automatic transmissions, a more forgiving suspension or a navigation system.

Even Defenders in rough condition don't deter him as long as the underpinnings are sound. "The chassis is really all that matters," he says.

Buyers are typically like Perlman himself, drivers who want a vehicle that stands out from the crowd. That certainly describes the Defender.

In an era when luxury vehicles usually means the sleekest of sedans or crossovers, an entrepreneur here is offering a rugged off-roader more at home fording the Ganges than the drive-thru at Wendy's. (Photo: Land Rover)View Fullscreen

![Matt Perlman, owner of West Coast Defenders, poses with one of the rugged Land Rover Defenders that he is fixing up and reselling at his Los Angeles facility. He has made a business out of importing and refurbishing the Land Rover Defender, a Jeep-type vehicle probably best known as the vehicle of choice for African safaris. It is a rugged, go-anywhere, easy-to-fix vehicle that is no longer sold in the U.S.]()

Matt Perlman, owner of West Coast Defenders, poses with one of the rugged Land Rover Defenders that he is fixing up and reselling at his Los Angeles facility. He has made a business out of importing and refurbishing the Land Rover Defender, a Jeep-type vehicle probably best known as the vehicle of choice for African safaris. It is a rugged, go-anywhere, easy-to-fix vehicle that is no longer sold in the U.S. (Photo: Chris Woodyard, USA TODAY)View Fullscreen

![A line of mid-1980s Land Rover Defenders awaits upgrades outside of the West Coast Defenders shop. The outfit buys vintage Defenders in the U.S. and imports them from around the world, then brings them up to modern standards and resells them. It has sold about 30 so far.]()

A line of mid-1980s Land Rover Defenders awaits upgrades outside of the West Coast Defenders shop. The outfit buys vintage Defenders in the U.S. and imports them from around the world, then brings them up to modern standards and resells them. It has sold about 30 so far. (Photo: Chris Woodyard, USA TODAY)View Fullscreen

!["Our main goal is to keep them as authentic as possible while bringing them into the 21st century," Perlman says. After tracking down good prospects in Europe, Africa or Asia, Perlman goes through the Defender looking for anything that needs to be fixed or adding comforts based on what its new owners wants -- whether it's automatic transmissions, a more forgiving suspension or a navigation system.]()

"Our main goal is to keep them as authentic as possible while bringing them into the 21st century," Perlman says. After tracking down good prospects in Europe, Africa or Asia, Perlman goes through the Defender looking for anything that needs to be fixed or adding comforts based on what its new owners wants -- whether it's automatic transmissions, a more forgiving suspension or a navigation system. (Photo: Chris Woodyard, USA TODAY)View Fullscreen

![Land Rover Defenders are so rugged that the roof, or in this case, a fender, have plating so they can be walked on. That feature comes in handy if you are outside the vehicle and trying to fend off a pride of lions that happen to walk by.]()

Land Rover Defenders are so rugged that the roof, or in this case, a fender, have plating so they can be walked on. That feature comes in handy if you are outside the vehicle and trying to fend off a pride of lions that happen to walk by. (Photo: Chris Woodyard, USA TODAY)View Fullscreen

![The 2012 Land Rover Defender 90 Hard Top in Fuji White driving off-road in Scotland.]()

The 2012 Land Rover Defender 90 Hard Top in Fuji White driving off-road in Scotland. (Photo: Land Rover)View Fullscreen

![They come in a fair amount of variety. There are both hardtops and those with removable roofs. Some have a 90-inch wheelbase while others are lengthened four-door models with 110-inch wheelbases. Some have benches in the rear on either side, while others have a pickup bed in back. One Defender that Perlman brought in from Texas had a snorkel, a breathing tube mounted next to the front roof pillar so that the engine can suck air while wading through hood-deep rivers.]()

They come in a fair amount of variety. There are both hardtops and those with removable roofs. Some have a 90-inch wheelbase while others are lengthened four-door models with 110-inch wheelbases. Some have benches in the rear on either side, while others have a pickup bed in back. One Defender that Perlman brought in from Texas had a snorkel, a breathing tube mounted next to the front roof pillar so that the engine can suck air while wading through hood-deep rivers. (Photo: Land Rover)View Fullscreen

![A car fancier, he says he was first attracted to the Defender at age 15. He was a lawyer driving a BMW, but decided to act on his fondness for Defenders. He tracked down his first in Alabama. Soon, his friends were asking about them, and he started finding new ones. "My favorite part of this is finding the vehicles," he says.]()

A car fancier, he says he was first attracted to the Defender at age 15. He was a lawyer driving a BMW, but decided to act on his fondness for Defenders. He tracked down his first in Alabama. Soon, his friends were asking about them, and he started finding new ones. "My favorite part of this is finding the vehicles," he says. (Photo: Land Rover)View Fullscreen

![It has been sold sporatically in the U.S., disappearing from 1987 to 1993 when only the Range Rover was in showrooms. Then, Land Rover imported only 500 into the U.S. in the belief that it needed to be rediscovered. The following year, 1994, in came another 3,000. But by 1996, Defenders could no longer meet toughening emissions requirements in the U.S., and they've been gone since.]()

It has been sold sporatically in the U.S., disappearing from 1987 to 1993 when only the Range Rover was in showrooms. Then, Land Rover imported only 500 into the U.S. in the belief that it needed to be rediscovered. The following year, 1994, in came another 3,000. But by 1996, Defenders could no longer meet toughening emissions requirements in the U.S., and they've been gone since. (Photo: Land Rover)View Fullscreen

![They are being snapped up by luxury buyers who appear to be more into the rugged image than making full use of the Defenders' off-road skills. Angelina Jolie drove one in the movie in which she played fictional explorer Lara Croft. Queen Elizabeth, who, when she is not decked out in crown and gown, has been seen driving her Defender through the back woods of her country estates.]()

They are being snapped up by luxury buyers who appear to be more into the rugged image than making full use of the Defenders' off-road skills. Angelina Jolie drove one in the movie in which she played fictional explorer Lara Croft. Queen Elizabeth, who, when she is not decked out in crown and gown, has been seen driving her Defender through the back woods of her country estates. (Photo: Land Rover)View Fullscreen

![For all of its regal owners, it's hardly a fancy vehicle. Because the no-nonsense vehicle was created for the toughest work in the most primitive places, it is full of exposed bolts made to be easily removable -- or if no parts are available, easy to jury-rig. "With five tools, you could take the whole car apart," Perlman says.]()

For all of its regal owners, it's hardly a fancy vehicle. Because the no-nonsense vehicle was created for the toughest work in the most primitive places, it is full of exposed bolts made to be easily removable -- or if no parts are available, easy to jury-rig. "With five tools, you could take the whole car apart," Perlman says. (Photo: Land Rover)View Fullscreen

![Land Rover Defender driving off road through water.]()

Land Rover Defender driving off road through water. (Photo: Land Rover)View Fullscreen

![Perlman sticks to finding mid-1980s models because they are easier to bring in under U.S. import laws. He says so far finding the vehicles has been tougher than finding customers.]()

Perlman sticks to finding mid-1980s models because they are easier to bring in under U.S. import laws. He says so far finding the vehicles has been tougher than finding customers. (Photo: Land Rover)View Fullscreen

![Land Rover Defender. 10" Defender Camel Vehicle.]()

Land Rover Defender. 10" Defender Camel Vehicle. (Photo: Land Rover)View Fullscreen

![Land Rover Defender. 110" Matt Track Conversion.]()

Land Rover Defender. 110" Matt Track Conversion. (Photo: Land Rover)View Fullscreen

![Land Rover Defender in quarry.]()

Land Rover Defender in quarry. (Photo: Land Rover)View Fullscreen

![Land Rover Defender. A 110" wading through a river.]()

Land Rover Defender. A 110" wading through a river. (Photo: Land Rover)View Fullscreen

![Land Rover Defender. LR Heritage Defender 130 in fire engine mode.]()

Land Rover Defender. LR Heritage Defender 130 in fire engine mode. (Photo: Land Rover)View FullscreenLike this topic? You may also like these photo galleries:Replay

AutoplayShow ThumbnailsShow CaptionsLast SlideNext Slide

They are being snapped up by luxury buyers who want to appear to be more into the rugged image than into making full use of the Defender's off-road prowess. They do, after all, show up in the hands of celebrities and royalty. Angelina Jolie drove one in the movie in which she played fictional explorer Lara Croft. Queen Elizabeth, when she is not decked out in crown and gown, has been seen driving her Defender on her country estates.

"I love getting people into these cars," Perlman says. Though it may look primitive, "It's an easy car to drive."

Because the no-nonsense vehicle was created for the toughest work in the most primitive places, it is full of exposed bolts made to make parts easily replaceable — or, if no parts are available, easy to jury-rig. "With five tools, you could take the whole car apart," Perlman says.

It's that kind of British can-do that made a name for Land Rover long before it became associated almost entirely with the plush Range Rover. Nothing was ever fancy about Defender. It was simply called the Land Rover 90 or 110 — denoting the length of the wheelbase — until 1990, when the Defender name was created, says Bob Burns, a Land Rover events manager who has kept on eye on the Defender in his 27 years with the company.

The Rover Co! . and suc! cessor British Leyland sold Land Rover vehicles in the U.S. from the 1950s through 1974. Then the brand was pulled out of the U.S. and didn't return until 1987, Burns says. It came back with the super-luxe Range Rover SUV, which found instant appeal among executives and celebrities for its creature comforts and rugged heritage.

But the Defender didn't reappear until 1993 when 500 were brought to the U.S. in an attempt to revive the model. In each of the following model years, 1994 and 1995, the company — by then owned by BMW — brought in a total about 5,000.

By 1996, Defenders could no longer meet toughening emissions requirements in the U.S., and they weren't sold for that model year. A few were imported for the 1997 model year, but Land Rover stopped selling them altogether because the relatively small sales value could not justify a list of other costly modifications required by U.S. law, says Burns.

The Defender continues to be sold in other parts of the world, and Land Rover — now owned by India's Tata — hasn't shut the door on reintroducing the model. "It's always on our radar," Burns says.

Perlman sticks to finding mid-1980s models because they are easier to bring in under U.S. import laws and require less modification to be legal on U.S. roads. He says finding suitable vehicles has so far been tougher than finding prospective customers.

A car fancier, Perlman says he was first attracted to the Defender at age 15. Later in life, he was a lawyer driving a BMW, but decided to act on his longtime fondness for Defenders, tracking down his first one in Alabama. Soon, his friends were asking about them, and he started finding more.

The thrill of the chase continues as part of the new business. "My favorite part of this is finding the vehicles," he says.

They come with a fair amount of variety. There are hardtops and those with removable roofs. Some have benches in the rear on either side, while others have a pickup bed in back. One Defender that Perlman! brought ! from Texas had a snorkel for the engine — a breathing tube mounted next to the front roof pillar so that the engine can suck air while fender-deep fording rivers.

Is Perlman's redoing of classic Defenders a solid business idea?

"He's absolutely on to something," says Land Rover's Burns. "They aren't making any more of them."

) is now more likely to acquire BlackBerry.

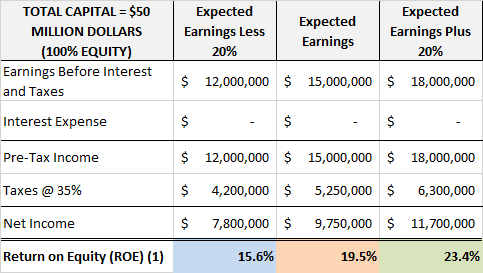

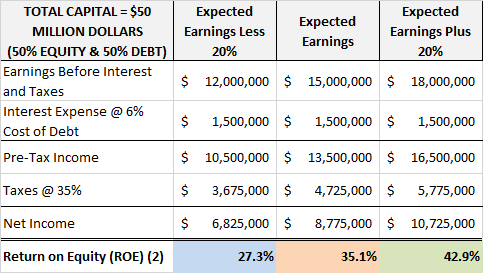

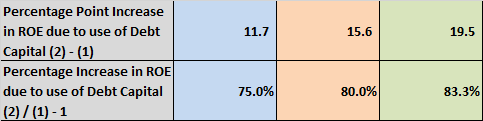

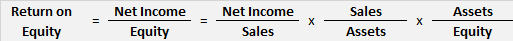

) is now more likely to acquire BlackBerry. When the U.S. Federal Reserve, which has been manipulating interest rates down to historic lows, said it was going to begin "tapering" its massive purchases of Treasury bills, notes and bonds, and mortgage-backed securities, the bond market got nervous. The Fed had managed rates down by exercising its quantitative easing (QE) program and announced it was paring back QE purchases because it saw the economy picking up.

When the U.S. Federal Reserve, which has been manipulating interest rates down to historic lows, said it was going to begin "tapering" its massive purchases of Treasury bills, notes and bonds, and mortgage-backed securities, the bond market got nervous. The Fed had managed rates down by exercising its quantitative easing (QE) program and announced it was paring back QE purchases because it saw the economy picking up. In an era when luxury vehicles usually means the sleekest of sedans or crossovers, an entrepreneur here is offering a rugged off-roader more at home fording the Ganges than the drive-thru at Wendy's. (Photo: Land Rover)View Fullscreen

In an era when luxury vehicles usually means the sleekest of sedans or crossovers, an entrepreneur here is offering a rugged off-roader more at home fording the Ganges than the drive-thru at Wendy's. (Photo: Land Rover)View Fullscreen Matt Perlman, owner of West Coast Defenders, poses with one of the rugged Land Rover Defenders that he is fixing up and reselling at his Los Angeles facility. He has made a business out of importing and refurbishing the Land Rover Defender, a Jeep-type vehicle probably best known as the vehicle of choice for African safaris. It is a rugged, go-anywhere, easy-to-fix vehicle that is no longer sold in the U.S. (Photo: Chris Woodyard, USA TODAY)View Fullscreen

Matt Perlman, owner of West Coast Defenders, poses with one of the rugged Land Rover Defenders that he is fixing up and reselling at his Los Angeles facility. He has made a business out of importing and refurbishing the Land Rover Defender, a Jeep-type vehicle probably best known as the vehicle of choice for African safaris. It is a rugged, go-anywhere, easy-to-fix vehicle that is no longer sold in the U.S. (Photo: Chris Woodyard, USA TODAY)View Fullscreen A line of mid-1980s Land Rover Defenders awaits upgrades outside of the West Coast Defenders shop. The outfit buys vintage Defenders in the U.S. and imports them from around the world, then brings them up to modern standards and resells them. It has sold about 30 so far. (Photo: Chris Woodyard, USA TODAY)View Fullscreen

A line of mid-1980s Land Rover Defenders awaits upgrades outside of the West Coast Defenders shop. The outfit buys vintage Defenders in the U.S. and imports them from around the world, then brings them up to modern standards and resells them. It has sold about 30 so far. (Photo: Chris Woodyard, USA TODAY)View Fullscreen "Our main goal is to keep them as authentic as possible while bringing them into the 21st century," Perlman says. After tracking down good prospects in Europe, Africa or Asia, Perlman goes through the Defender looking for anything that needs to be fixed or adding comforts based on what its new owners wants -- whether it's automatic transmissions, a more forgiving suspension or a navigation system. (Photo: Chris Woodyard, USA TODAY)View Fullscreen

"Our main goal is to keep them as authentic as possible while bringing them into the 21st century," Perlman says. After tracking down good prospects in Europe, Africa or Asia, Perlman goes through the Defender looking for anything that needs to be fixed or adding comforts based on what its new owners wants -- whether it's automatic transmissions, a more forgiving suspension or a navigation system. (Photo: Chris Woodyard, USA TODAY)View Fullscreen Land Rover Defenders are so rugged that the roof, or in this case, a fender, have plating so they can be walked on. That feature comes in handy if you are outside the vehicle and trying to fend off a pride of lions that happen to walk by. (Photo: Chris Woodyard, USA TODAY)View Fullscreen

Land Rover Defenders are so rugged that the roof, or in this case, a fender, have plating so they can be walked on. That feature comes in handy if you are outside the vehicle and trying to fend off a pride of lions that happen to walk by. (Photo: Chris Woodyard, USA TODAY)View Fullscreen The 2012 Land Rover Defender 90 Hard Top in Fuji White driving off-road in Scotland. (Photo: Land Rover)View Fullscreen

The 2012 Land Rover Defender 90 Hard Top in Fuji White driving off-road in Scotland. (Photo: Land Rover)View Fullscreen They come in a fair amount of variety. There are both hardtops and those with removable roofs. Some have a 90-inch wheelbase while others are lengthened four-door models with 110-inch wheelbases. Some have benches in the rear on either side, while others have a pickup bed in back. One Defender that Perlman brought in from Texas had a snorkel, a breathing tube mounted next to the front roof pillar so that the engine can suck air while wading through hood-deep rivers. (Photo: Land Rover)View Fullscreen

They come in a fair amount of variety. There are both hardtops and those with removable roofs. Some have a 90-inch wheelbase while others are lengthened four-door models with 110-inch wheelbases. Some have benches in the rear on either side, while others have a pickup bed in back. One Defender that Perlman brought in from Texas had a snorkel, a breathing tube mounted next to the front roof pillar so that the engine can suck air while wading through hood-deep rivers. (Photo: Land Rover)View Fullscreen A car fancier, he says he was first attracted to the Defender at age 15. He was a lawyer driving a BMW, but decided to act on his fondness for Defenders. He tracked down his first in Alabama. Soon, his friends were asking about them, and he started finding new ones. "My favorite part of this is finding the vehicles," he says. (Photo: Land Rover)View Fullscreen

A car fancier, he says he was first attracted to the Defender at age 15. He was a lawyer driving a BMW, but decided to act on his fondness for Defenders. He tracked down his first in Alabama. Soon, his friends were asking about them, and he started finding new ones. "My favorite part of this is finding the vehicles," he says. (Photo: Land Rover)View Fullscreen It has been sold sporatically in the U.S., disappearing from 1987 to 1993 when only the Range Rover was in showrooms. Then, Land Rover imported only 500 into the U.S. in the belief that it needed to be rediscovered. The following year, 1994, in came another 3,000. But by 1996, Defenders could no longer meet toughening emissions requirements in the U.S., and they've been gone since. (Photo: Land Rover)View Fullscreen

It has been sold sporatically in the U.S., disappearing from 1987 to 1993 when only the Range Rover was in showrooms. Then, Land Rover imported only 500 into the U.S. in the belief that it needed to be rediscovered. The following year, 1994, in came another 3,000. But by 1996, Defenders could no longer meet toughening emissions requirements in the U.S., and they've been gone since. (Photo: Land Rover)View Fullscreen They are being snapped up by luxury buyers who appear to be more into the rugged image than making full use of the Defenders' off-road skills. Angelina Jolie drove one in the movie in which she played fictional explorer Lara Croft. Queen Elizabeth, who, when she is not decked out in crown and gown, has been seen driving her Defender through the back woods of her country estates. (Photo: Land Rover)View Fullscreen

They are being snapped up by luxury buyers who appear to be more into the rugged image than making full use of the Defenders' off-road skills. Angelina Jolie drove one in the movie in which she played fictional explorer Lara Croft. Queen Elizabeth, who, when she is not decked out in crown and gown, has been seen driving her Defender through the back woods of her country estates. (Photo: Land Rover)View Fullscreen For all of its regal owners, it's hardly a fancy vehicle. Because the no-nonsense vehicle was created for the toughest work in the most primitive places, it is full of exposed bolts made to be easily removable -- or if no parts are available, easy to jury-rig. "With five tools, you could take the whole car apart," Perlman says. (Photo: Land Rover)View Fullscreen

For all of its regal owners, it's hardly a fancy vehicle. Because the no-nonsense vehicle was created for the toughest work in the most primitive places, it is full of exposed bolts made to be easily removable -- or if no parts are available, easy to jury-rig. "With five tools, you could take the whole car apart," Perlman says. (Photo: Land Rover)View Fullscreen Land Rover Defender driving off road through water. (Photo: Land Rover)View Fullscreen

Land Rover Defender driving off road through water. (Photo: Land Rover)View Fullscreen Perlman sticks to finding mid-1980s models because they are easier to bring in under U.S. import laws. He says so far finding the vehicles has been tougher than finding customers. (Photo: Land Rover)View Fullscreen

Perlman sticks to finding mid-1980s models because they are easier to bring in under U.S. import laws. He says so far finding the vehicles has been tougher than finding customers. (Photo: Land Rover)View Fullscreen Land Rover Defender. 10" Defender Camel Vehicle. (Photo: Land Rover)View Fullscreen

Land Rover Defender. 10" Defender Camel Vehicle. (Photo: Land Rover)View Fullscreen Land Rover Defender. 110" Matt Track Conversion. (Photo: Land Rover)View Fullscreen

Land Rover Defender. 110" Matt Track Conversion. (Photo: Land Rover)View Fullscreen Land Rover Defender in quarry. (Photo: Land Rover)View Fullscreen

Land Rover Defender in quarry. (Photo: Land Rover)View Fullscreen Land Rover Defender. A 110" wading through a river. (Photo: Land Rover)View Fullscreen

Land Rover Defender. A 110" wading through a river. (Photo: Land Rover)View Fullscreen Land Rover Defender. LR Heritage Defender 130 in fire engine mode. (Photo: Land Rover)View FullscreenLike this topic? You may also like these photo galleries:Replay

Land Rover Defender. LR Heritage Defender 130 in fire engine mode. (Photo: Land Rover)View FullscreenLike this topic? You may also like these photo galleries:Replay