While most of you would find it a little difficult to digest that there are investors who have the money but don't know what to do with it, but that's the truth. Don't believe us, just look around and see the number of people with the latest gizmos, iphones, cars, clothes and consumer goods. What's wrong with that? Nothing at all! It's a free world and you can own anything and everything that your finances permit you to. Do this small test, when you see someone flashing his latest iphone or some gizmo, ask him if he has planned for his retirement, or whether he has a financial plan in place to pay for his child's college fees 10 years down the line. Chances are that person will be more keen on discussing 'relevant' points like the features of his latest iphone rather than dwell on the 'irrelevant' issues raised by you.

To be sure, these issues (like the features of a latest iphone) are anything but irrelevant. But money has that effect on people, it makes them want to rush towards the immediate and ignore the future. So you have more iphones being bought than financial plans being prepared.

So, although it's good to have money, it's equally important to know what to do with it. We list 5 most critical tasks individuals must accomplish with their money.

1. Do your tax planning

If you are liable to pay tax, tie up your tax planning exercise. As a law-abiding citizen paying taxes is most important and so investing promptly in the right avenue to save tax assumes importance too. An individual can save tax upto Rs 100,000 by investing in tax-saving investment avenues. These avenues range from the traditional Public Provident Fund (PPF), National Saving Certificate (NSC) and life insurance to the more dynamic tax saving mutual funds (Equity Linked Saving Schemes - ELSS). These avenues not only help in tax planning but if selected well can also help individuals achieve their long-term financial goals.

2. Plan now for your retirement

A common regret for most of us in our twilight years (apart from not having exercised enough) is our poor savings and investment track record. Most individuals wish they had saved either better or more. Planning for retirement is one thing that individuals across age groups must take up on priority. Of course, if you start at an early stage it's even better, but the fact is it's never too late to set aside some money for retirement.

What makes retirement planning so important for us to list it second in our 'to do' list? The answer to that question is the inflation. Inflation is what usually leads to a rise in prices of goods and services. If you are wondering why oil, the gas cylinder, toothpaste, eggs and even 'idli sambhaar' costs a lot more than what it used to even 5 years ago, blame it on inflation. So planning earlier on in your life is a solution. Calculations show that even a 5-year delay in investing (Rs 10,000 annually at 10%) can make a substantial difference (as high as 40%) to your retirement corpus.

1 2

.gD_15nRedN{font:15px/20px Arial;color:#FF0000 !important;text-decoration:none;font-weight:normal;}

Related News

Risk-return relationship: High return is the risk premium Would falling rupee make bank FDs attractive?

.gD_15nRed{font:15px/20px Arial;color:#FF0000 !important;text-decoration:none;font-weight:bold;}

.GoogleNewsTitle{font:14px/16px Trebuchet MS,Arial,Helvetica,sans-serif;color:#005066;text-decoration:none;} .GoogleNewsTitle:hover{text-decoration:underline} .GoogleNewsURL{font:12px Trebuchet MS,Arial,Helvetica,sans-serif;color:#000;text-decoration:none;} .GoogleNewsURL:hover{text-decoration:underline} .GoogleNewsTitleLine{font:20px/22px Trebuchet MS,Arial,Helvetica,sans-serif;color:#F01414;text-decoration:none} .GoogleNewsTitleLine:hover{text-decoration:underline} .GoogleNewsLineURL{font:12px family:Trebuchet MS,Arial,Helvetica,sans-serif;color:#000;text-decoration:none} .GoogleNewsLineURL:hover{text-decoration:underline}

Tags: tax planning, personalfn.com

Hold Praj Industries; target Rs 35: ICICIdirect.com

Broad-based boost key; India still hot investment hub: Gill

.scroll_hv .panel{width:250px !important; padding:10px 10px 25px !important} #scroll13{width:540px;} .hv_bx{margin-left:-10px;} .tab_data1{padding:0px;}

Get Quote Stock Chart Future Price Opti

More than four years removed from the deepest recession the U.S. witnessed since the Great Depression, many investors are finally beginning to see the proverbial light at the end of the tunnel. The U.S. unemployment rate hit a four-and-a-half-year low in April of just 7.5%, while the housing market continues to find solid footing with regard to both housing starts and rising home prices. If I didn't know any better, I'd call this a slow but steady recovery of the U.S. economy. But a deeper dive into the condition of the labor force reveals stark dissimilarities between the economic data we've been seeing and what's really happening. It's been my postulation for weeks that there's a large dissociation between labor participation, wages, and satisfaction, and the economic data we've been delivered could be a worrisome sign of things to come for the Dow Jones Industrial Average (DJINDICES: ^DJI ) and broad-based S&P 500 (SNPINDEX: ^GSPC ) which both eclipsed all-time highs earlier this year. Here are eight incredible, depressing, and alarming labor force statistics that certainly have me thinking twice about the market's ability to keep heading higher. 70% of the full-time labor force is "not engaged"

According to a Gallup poll of full-time workers conducted between 2010 and 2012, of the roughly 100 million in the labor force, only 30 million are considered engaged with their job. The remaining 70% are considered "not engaged," or apathetic, toward their job, while 18%, or 18 million, full-time employees are actively disengaged from their employer and potentially looking to undermine their company. These disengaged workers are responsible for costing U.S. businesses upward of half a trillion dollars each year. Duration of unemployment has more than doubled in five years to 37 weeks

The average length of time it takes to find a job has risen dramatically in just the past five years. In May 2008, it took an unemployed worker 16.6 weeks to find employment. Last month, that figure stood at 36.9 weeks. Amazingly enough, that's down from a high of 40.7 weeks set in December 2011. Unemployment levels may be falling, but finding a job, based on these figures, is still very difficult. U.S. real hourly earnings have risen by a grand total of 2% -- in the past 33 years!

An easy way to create a disgruntled labor force is to make it difficult for workers to pay for the things they need. Since 1980, nominal hourly wages for U.S. workers have risen by 205.6%. On the surface, it would appear that employees are enjoying the benefits of increased productivity. However, when adjusted for inflation, real wages for U.S. workers have grown an abysmal 2.1% since January 1980. Meanwhile, many costs, including health care and gasoline, have increased by much more than 2% in real terms over the same period. Health care benefits account for approximately 20% of workers' compensation

If you're curious where workers' real wage raises have gone, look no further than the health care sector. In the 1960s, health care expenses accounted for less than 10% of workers' compensation. By 2011, that figure had jumped to just shy of 20%. What's more distressing is that health care costs as a percentage of compensation could potentially soar for some middle-class Americans with the upcoming implementation of the Patient Protection and Affordable Care Act. No longer able to get by with a bare-bones health plan, many middle-class Americans could see up to a triple-digit spike in their health care premiums. The labor force participation rate hit a 34-year low of 63.3% in April

The cumulative labor force participation rate -- essentially a measure of the current labor force as compared to the number of adults within the same age range -- has been on a steady decline since 2000.  Source: Bureau of Labor Statistics. Certainly, the rising number of Americans entering retirement, going to college, and collecting Social Security disability has caused a drop in the labor force participation rate. However, there's little denying that nonexistent real wage growth and an average unemployment period of almost three-quarters of a year are discouraging factors that have caused workers to simply give up trying to find a job.

Labor union membership hit a 97-year low of 11.3% last year

According to the Bureau of Labor Statistics, union membership declined by 400,000 last year to just 14.3 million members. Tougher anti-union laws in Wisconsin and Indiana, as well as corporate expansion into non-union states, were blamed for much of the decline. Boeing (NYSE: BA ) , for instance, has been expanding its production in South Carolina, and last month it announced plans to shift its engineering work to the Palmetto State and to Long Beach, Calif. -- both non-union sites. If this trend continues, any bargaining power labor unions possess may soon disappear. Less than a third of workers are satisfied with their pay and their jobs' stress level

Based on a Gallup poll on U.S. employee satisfaction conducted in August of last year, only 30% of respondents claimed to be completely satisfied with their pay, while just 29% were completely satisfied with their jobs' stress level. On the opposite end of the spectrum, 28% said they were completely dissatisfied with their pay, and 33% reported being completely dissatisfied with the stress level of their job. This reinforces the notion that as productivity growth outpaces wage growth, the labor force is growing more stressed. Currently at 57.3%, women's labor force participation rate has been declining since 2000

Having grown throughout the 20th century, women's participation in the labor force simply stopped growing in 2000 and has even been on the decline over the past decade.

Source: St. Louis Federal Reserve.

Partly to blame are restrictive labor laws that can make it difficult for a working mother to raise a family. Many other developed nations offer a longer maternity leave period than the U.S., and more than half of other developed countries have passed legislation prohibiting discrimination against part-time workers -- something that doesn't exist in the U.S. A slumping female labor participation rate is also particularly worrisome because more women than men are now obtaining college degrees, according to the U.S. Census Bureau. The takeaway

We may be witnessing bits and pieces of the economy improving, but make no mistake about it: The labor force appears to be in pretty dismal shape. Workers are the root of ingenuity and innovation; without their desire to outperform, as well as a pay structure that outpaces inflation, corporations don't have much hope of delivering meaningful top- or bottom-line growth. These eight depressing statistics should give investors plenty of reason to be skeptical of what could really be wrong with the Dow Jones Industrial Average and S&P 500 at these levels -- and they certainly shouldn't be taken lightly. With the American markets reaching new highs, investors and pundits alike are skeptical about future growth. They shouldn't be. Many global regions are still stuck in neutral, and their resurgence could result in windfall profits for select companies. A recent Motley Fool report, "3 Strong Buys for a Global Economic Recovery" outlines three companies that could take off when the global economy gains steam. Click here to read the full report!

Two years ago, I identified 10 companies that I would be putting $40,000 of my own retirement money behind. This was, has been, and will continue to be my way of helping the world to invest better. Since then, that sum of money has grown to $54,280 -- a 35.7% increase, and $2,040 better than if I had just invested the money in the S&P 500. Every month, I look over these stocks to see which three are tempting. I call these my "Buy Now" stocks because I think they're pretty good deals. Read the chart below to see how the whole portfolio has performed, check out my best buys and, at the end, I'll offer up access to a special premium report on one of the 10 stocks. Company Publication Date Change Vs. S&P 500 (percentage points) | Google (NASDAQ: GOOG ) | 6/26/11 | 80.8% | 47 | | Pricesmart | 6/28/11 | 71.8% | 40 | | Baidu (NASDAQ: BIDU ) | 9/15/12 | (12.3%) | (42) | | Intuitive Surgical | 7/25/11 | 24.6% | (3) | | National Oilwell Varco (NYSE: NOV ) | 7/28/11 | (12%) | (43) | | Coca-Cola | 6/21/11 | 27.7% | (4) | | Whole Foods | 7/5/11 | 69.3% | 42 | | Amazon | 7/12/11 | 28% | (2) | | Apple | 6/30/11 | 37.5% | 8 | | Johnson & Johnson | 8/1/11 | 41.4% | 9 | | | | | | | Total | | 35.7% | 5.0 | Source: YCharts Though it's important to keep a long-term horizon, it's also worth noting that these "best buy" lists can quickly yield great results. For instance, had you bought the three stocks I suggested in May of 2012, you'd be sitting on average returns of 32%, far outpacing the S&P 500's return of just 19% since then! So, without further ado, here are my three picks for June: Google

Yes, Google stock has appreciated almost 50% over the past year. But this company has everything I look for in a buy-and-forget holding: top-notch management, a moat as wide as can be, and a culture of innovation that could create multiple profitable futures. While some scoff at Google's latest experiments with computing glasses, I think its reasonable to assume that wearable technology will be the next frontier for personal computing. Even if Glass isn't a raging success, the fact that the company is innovative and willing to work on such products lets me know that people will continue using Google's search engine --which is really what drives revenue -- for years to come. Long term, Google is trading hands at 16 times expected 2014 earnings. That seems like a fair price for one of the world's best companies. Baidu

I'm waiting for someone to hit me over the head for continuing to put Baidu on this list month after month. Indeed, the stock has lost 18% of its value over the past year, and I've been recommending it all the way down. Why do I continue to do so? Because I believe that, while some concerns pushing the stock down are legitimate, they are short term in nature. First is the concern about Qihoo 360. Though the fiery start-up has managed to capture 15% of China's search market, Baidu has the lion's share of the rest. Furthermore, as Baidu is spending the money now to build out the type of infrastructure and mobile strategy that will keep it relevant for years to come, Qihoo simply doesn't have the financial resources to match what Baidu is doing. The other big concern is the possibility of a slowdown in the Chinese economy. Though this would put a dent in Baidu's revenue, it still doesn't justify the company's low price. Baidu has a much bigger market to capture with small- and medium-sized businesses in China than Google does globally, but trades for only 20 times earnings. Google has more tame growth prospects, and yet it trades at a 30% premium to Baidu. That just doesn't add up. National Oilwell Varco

NOV supplies all the nuts and bolts needed by the oil and gas industry to extract energy from the earth. Though the earnings report from the first quarter disappointed Wall Street, the company's backlog shows that there is growing demand to upgrade the world's aging oil rig fleet. That, combined with the company's ubiquity in the industry and the fact that any up-tick in energy prices will be good for NOV shareholders, means that the company's best days are probably ahead of it. Trading at just 12 times earnings, and offering a fair 1.5% dividend yield, this is a very safe pick for any investor's retirement portfolio. Want to know more?

To help determine if National Oilwell Varco could be a good fit for your portfolio, you're invited to check out The Motley Fool's premium research report featuring in-depth analysis on whether NOV is a buy today. For instant access to this valuable investor's resource, simply click here now to claim your copy.

Every quarter, many money managers have to disclose what they've bought and sold, via "13F" filings. Their latest moves can shine a bright light on smart stock picks. Today, let's look at investing giant Daniel Loeb, founder of the Third Point LLC hedge fund. Loeb is a well-known activist investor, famous for publicly airing his opinions about companies in which he invests and not mincing words when he's displeased. Loeb was instrumental in pointing out discrepancies in former Yahoo! CEO Scott Thompson's biography -- paving the way for Yahoo!'s new CEO, Marissa Mayer. More recently, he's looking to break up Sony. His activity bears watching, because the guy seems to know a thing or two about investing. According to the folks at GuruFocus.com, over the 15 recent years ending in 2012, Loeb racked up a cumulative gain of 758%, compared with just 94% for the S&P 500. The company's reportable stock portfolio totaled $5.3 billion in value as of March 31, 2013. Interesting developments

So what does Third Point's latest quarterly 13F filing tell us? Here are a few interesting details: The biggest new holdings are Virgin Media and Tiffany. Other new holdings of interest include TIBCO Software (NASDAQ: TIBX ) , a Big Data operator that posted mixed results recently as it invests in a more cloud-computing-oriented future. It's been adding recurring-revenue contracts and some speculate that it may end up acquired by another. Third Point reduced its stake in lots of companies, including Murphy Oil and Yahoo! Among holdings in which it increased its stake were AbbVie (NYSE: ABBV ) and ARIAD Pharmaceuticals (NASDAQ: ARIA ) . AbbVie was split off from Abbott Labs (NYSE: ABT ) and kept the pharmaceutical business. Detractors don't like its heavy debt or the impending patent expiration of its rheumatoid arthritis drug Humira, which is expected to generate more than $10 billion in annual sales. It has other drugs on the market and in its pipeline, tackling Hepatitis C, among other conditions. (A Hep C treatment just received FDA breakthrough designation.) It also sports a 3.5% dividend yield, and its chief scientific officer is retiring, which should interest investors. ARIAD received FDA approval for its leukemia drug Iclusig, though its launch hasn't been as strong as some had hoped. The company's bone-tumor drug ridaforolimus was rejected in Europe, but it might still prove effective against other cancers. ARIAD needs some more success from its pipeline. Investors are hoping for European approval for Iclusig and eventual approvals for other treatments. Finally, Third Point's biggest closed positions included Tesoro and Morgan Stanley. Other closed positions of interest include Herbalife (NYSE: HLF ) and Abbott Labs. Herbalife has some high-profile critics, such as David Einhorn of Greenlight Capital and Bill Ackman of Pershing Square Capital Management, though others, such as Carl Icahn, have been buyers. The company has been reporting solid results, with its first quarter featuring revenue up 17%, net profit up 10%, and expectations for double-digit, near-term growth. Some worry about its multilevel-marketing strategy, but those who believe and are patient can collect a dividend yield near 2.5%. Meanwhile, Abbott Labs is now focused on medical, diagnostic, and nutritional products. Its first-quarter results were solid, with the nutrition division especially strong, particularly in emerging markets. Its devices business was less strong, but it has just had a new stent approved. Wall Street analysts such as David Roman of Goldman Sachs have upped the company's rating recently. We should never blindly copy any investor's moves, no matter how talented the investor. But it can be useful to keep an eye on what smart folks are doing. 13-F forms can be great places to find intriguing candidates for our portfolios. Abbott Labs has changed forever after losing its branded pharmaceutical business to a spinoff. If you're a current investor, or might be buying shares soon, make sure you truly understand the stock by reading The Motley Fool's brand-new premium report on Abbott Labs. The report outlines all of the must-know opportunities and risks, along with a full year of analyst updates to keep you up to speed. Best of all, you can claim this report today by clicking here now.

Things never get dull for the country's lone satellite-radio provider. Shares of Sirius XM Radio (NASDAQ: SIRI ) moved lower this week, closing 2.3% lower to hit $3.01. The general market moved lower, and Sirius XM's dip wasn't as bad as the Nasdaq's 2.7% tumble. There was more going on beyond the share-price gyrations, though. Sirius XM officially announced the open availability of MySXM. Zacks upgraded the shares to a still uninspiring "neutral" rating. And after weeks of hype, Twitter introduced its music discovery platform. Let's take a closer look. MySXM marks the spot

Sirius XM is a few months late on its promise to deliver personalized radio by the end of last year, but MySXM is now out of beta and readily available. Pandora's (NYSE: P ) success with personalized radio is well documented. The fast-growing music discovery platform announced earlier this month that it has surpassed 200 million cumulative registrations -- and more than a third of them tuned in to consume 1.49 billion hours of content last month. MySXM is Sirius XM's response. Subscribers can fine-tune dozens of Sirius XM music channels, selecting as many as 100 variations on the already deep genre dive. It's a unique approach, and there's plenty riding on the platform if it's successful. MySXM isn't included with the standalone receiver-based subscription, but those who are already subscribers only have to pay $3.50 a month for Internet access that includes mobile streaming, on-demand content, and now MySXM. It's a retention tool, and it could be important if it helps boost conversion rates and lower churn. Jumping Zacks

Zacks Equity Research moved to upgrade the satellite-radio giant ahead of its quarterly report later this month. It isn't fair to call the move bullish. Zacks is merely boosting its rating to "neutral." However, it's also fair to say that the analysts at Zacks don't want to be seen as bearish when the financials do come out on April 30. "We expect the company's positive momentum with respect to revenue, margins, and free cash flow to continue in the near term," reads the press release announcing the move. Zacks isn't entirely sold on Sirius XM. It points to a new deal with General Motors (NYSE: GM ) -- an early investor and satellite-radio installer -- as potentially problematic. The new arrangement calls for the end of GM's payment of promotional money to Sirius XM, a move that Zacks concludes will force Sirius XM to miss out on some paid promotion subscribers. Zacks is also concerned about Liberty Media's (NASDAQ: LMCA ) completion of its move to take majority control of the company earlier this year. "We do not know whether there will be any change in management policy after the takeover," the release reads. However, it's still telling that Zacks times the upgrade less than two weeks before Sirius XM's next quarterly report. Tweet your tune

After weeks, if not months, of hype, Twitter #music went live to the masses. On the surface, it's pretty basic. It's just a platform -- available on desktop, but also via mobile apps -- that scours Twitter to surface the songs and emerging artists that users are talking about. It's more of an attack on Billboard's music charts than a threat to Pandora, Spotify, or even Sirius XM. However, it's also a tool that musical artists can use to more effectively promote their own material and the stuff that they happen to be listening to these days. It will increase the stickiness of Twitter, and that will be great for Twitter itself. Sirius XM, on the other hand, has little to worry about here -- for now. A Sirius future

Even though Sirius XM has been one of the market's biggest winners since bottoming out four years ago, there's still some healthy upside to be had if things go right for it -- and plenty of room for it to fall if things don't. Read all about Sirius in The Motley Fool's brand new premium report. To get started, just click here now.

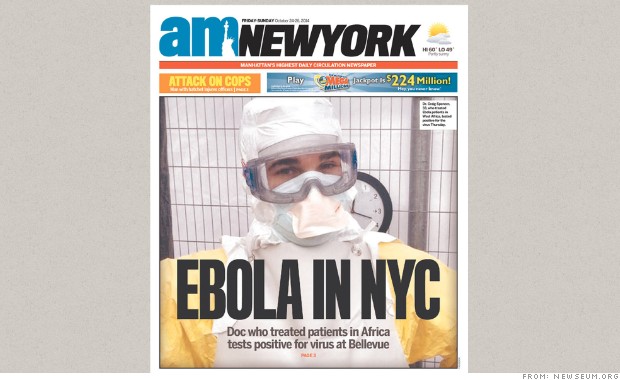

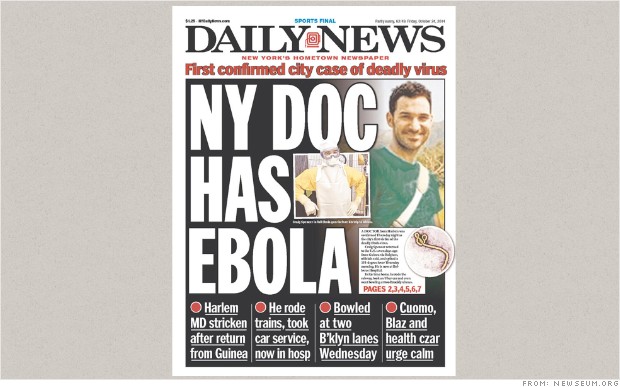

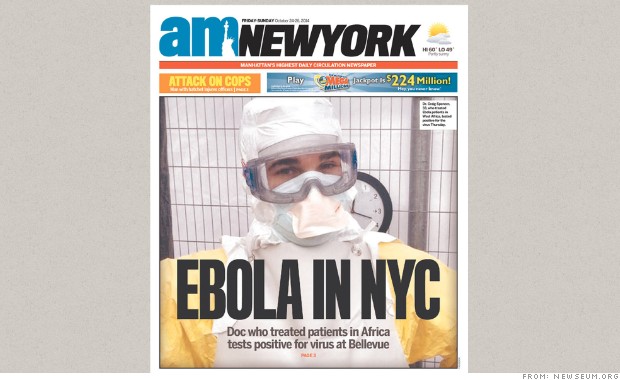

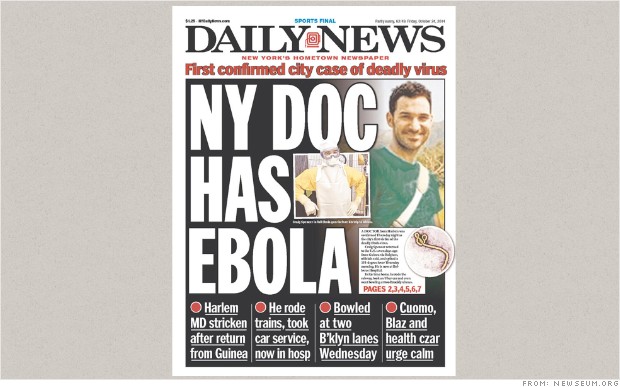

NEW YORK (CNNMoney) New York City's tabloids are known for headlines like "Headless Body In Topless Bar," "Ford to City: Drop Dead and "Derek Eater." But they played it straight when it was time to report that Dr. Craig Spencer tested positive for Ebola Thursday night. In the hours before Spencer was diagnosed he had gone bowling, rode the A train and stopped by a meatball shop. But there was not a single pun to be found on New York City newsstands Friday morning. No hysteria and no sensationalism. Instead newspapers like AM New York went with just the facts. The free daily's front page simply said "Ebola in NYC" and showed a picture of Spencer in a hazmat suit while caring for victims in West Africa: "We didn't want to be alarmists," said Pete Catapano, executive editor of AM New York. "Obviously it's a scary subject... We wanted to be very direct, very straight-forward."  The Daily News also took a tempered approach with its front page:  The New York Post (which is infamous for its outrageous covers) was a little more brash with its "Ebola Here!" headline, but did stick to just the facts:  "A subject like this... people make jokes about it. That's not our place to do that," Catapano said. "We just wanted to be very respectful, and let the story speak for itself."

Alamy With about 10 million new iPhone 6s ordered in the initial days on the market, a whole lot of old iPhones are destined for the scrap heap. Sure, you could sell, donate or recycle your old iPhone, but you probably won't. And there are better things to do with it. One creative example: At the Missouri University of Science and Technology, a biology class is making old iPhones into microscopes. Using less than $10 worth of supplies, the old phones are mounted onto a lens and can magnify an object to 175 times its size. Even an old phone with a cracked screen can be repurposed, says Josh Smith, editor of GottaBeMobile.com. "You're only really limited by your imagination," Smith says. Here are 10 smart -- and cheap -- uses for old iPhones. Clock Set your old phone on a dock or a stand and use a clock app. With Standard Time ($3.99), you will have a timepiece unlike any other. With this app, your clock is a non-stop time lapse video of construction workers switching out pieces of lumber to shape the actual time. "It's mesmerizing," says Shawn Roberts, 47, an Oakland, California, marketing executive. You can also set up flexible alarms and get the phone to play soothing white noise as you go to sleep. Set it close enough to the bed, and it can be a sleep tracker, too, with an app like SleepBot (free). Music For Your Car Take your music library on the road. Some cars come equipped with docking ports for iPhones and have dashboard screens so you can navigate your musical options hands-free. Or you can just use the cigarette lighter for power. Remote Control Televisions, speakers and other devices now have apps that allow users to make their iPhones into sleek remotes. Carm Lyman, 42, of Napa, California, converted his iPhone 4 into a remote for his household sound system after his iPhone 5 arrived. Lyman can control the audio levels and activate speakers in various parts of his home as well as access different music services. Surveillance System Apps can convert an old iPhone that has access to WiFi into a surveillance camera and motion detector. Presence, which is a free app, provides a live stream from the area you want to monitor. You can set it up to record video clips when it detects motion, too. If you buy a robotic viewing stand for about $100, you can move the camera 360 degrees rather than stick with a stationary view. Cookbook No need to go through recipe books or hunt around for other devices when you have a kitchen iPhone. Download a cookbook app, such as My Recipe Book (99 cents) or Big Oven (free), and just leave the device on the kitchen counter. It takes up almost no space and will hold far more recipes than any book. Extra Storage Need a place to store old photos and music or other files? Turn your old phone into a storage drive using a free app like USB & Wi-Fi Flash Drive. Voice Recorder Why buy a digital voice recorder when you have a retired iPhone? Using any of several free apps, including Voice Recorder and Voice Record Pro, you will have a designated memo recorder or a device to record interviews and speeches. Document Scanner Genius Scan and Doc Scan are two apps that will turn an iPhone into a handy portable scanner that you can use for work, school reports, genealogical research, or recording receipts. And they won't cost you a penny. For $20 and up, you can buy a stand that makes your iPhone into a stationary scanner. Baby Monitor Sure, you can spend $100 or more on a baby monitor, or you can just set your old iPhone up to watch streaming video of your baby as well as hear and even talk to him or her. Cloud Baby Monitor ($3.99) also allows parents to receive the signal on a wireless network or on Wi-Fi so they don't have to be within a certain number of feet of the monitor. Vehicle Tracker Whether you need to find your car if it is stolen, record where you have traveled, or spy on your teenage driver, the built-in GPS in your phone can be used as a tracking device. An app like InstaMapper ($2.99) lets you watch the vehicle in real-time and have a record of it. Of course, you may end up taking the simple path of letting a child use your old iPhone as an iPod Touch. Keep in mind that the phone can still dial 911, even if it does not have cellular service, Smith said. You can also use your old phone as a back-up in case your new model suffers irreparable harm. That said, the battery of a phone that sits in a drawer unused could drain to the point where it is no longer viable. Alamy With about 10 million new iPhone 6s ordered in the initial days on the market, a whole lot of old iPhones are destined for the scrap heap. Sure, you could sell, donate or recycle your old iPhone, but you probably won't. And there are better things to do with it. One creative example: At the Missouri University of Science and Technology, a biology class is making old iPhones into microscopes. Using less than $10 worth of supplies, the old phones are mounted onto a lens and can magnify an object to 175 times its size. Even an old phone with a cracked screen can be repurposed, says Josh Smith, editor of GottaBeMobile.com. "You're only really limited by your imagination," Smith says. Here are 10 smart -- and cheap -- uses for old iPhones. Clock Set your old phone on a dock or a stand and use a clock app. With Standard Time ($3.99), you will have a timepiece unlike any other. With this app, your clock is a non-stop time lapse video of construction workers switching out pieces of lumber to shape the actual time. "It's mesmerizing," says Shawn Roberts, 47, an Oakland, California, marketing executive. You can also set up flexible alarms and get the phone to play soothing white noise as you go to sleep. Set it close enough to the bed, and it can be a sleep tracker, too, with an app like SleepBot (free). Music For Your Car Take your music library on the road. Some cars come equipped with docking ports for iPhones and have dashboard screens so you can navigate your musical options hands-free. Or you can just use the cigarette lighter for power. Remote Control Televisions, speakers and other devices now have apps that allow users to make their iPhones into sleek remotes. Carm Lyman, 42, of Napa, California, converted his iPhone 4 into a remote for his household sound system after his iPhone 5 arrived. Lyman can control the audio levels and activate speakers in various parts of his home as well as access different music services. Surveillance System Apps can convert an old iPhone that has access to WiFi into a surveillance camera and motion detector. Presence, which is a free app, provides a live stream from the area you want to monitor. You can set it up to record video clips when it detects motion, too. If you buy a robotic viewing stand for about $100, you can move the camera 360 degrees rather than stick with a stationary view. Cookbook No need to go through recipe books or hunt around for other devices when you have a kitchen iPhone. Download a cookbook app, such as My Recipe Book (99 cents) or Big Oven (free), and just leave the device on the kitchen counter. It takes up almost no space and will hold far more recipes than any book. Extra Storage Need a place to store old photos and music or other files? Turn your old phone into a storage drive using a free app like USB & Wi-Fi Flash Drive. Voice Recorder Why buy a digital voice recorder when you have a retired iPhone? Using any of several free apps, including Voice Recorder and Voice Record Pro, you will have a designated memo recorder or a device to record interviews and speeches. Document Scanner Genius Scan and Doc Scan are two apps that will turn an iPhone into a handy portable scanner that you can use for work, school reports, genealogical research, or recording receipts. And they won't cost you a penny. For $20 and up, you can buy a stand that makes your iPhone into a stationary scanner. Baby Monitor Sure, you can spend $100 or more on a baby monitor, or you can just set your old iPhone up to watch streaming video of your baby as well as hear and even talk to him or her. Cloud Baby Monitor ($3.99) also allows parents to receive the signal on a wireless network or on Wi-Fi so they don't have to be within a certain number of feet of the monitor. Vehicle Tracker Whether you need to find your car if it is stolen, record where you have traveled, or spy on your teenage driver, the built-in GPS in your phone can be used as a tracking device. An app like InstaMapper ($2.99) lets you watch the vehicle in real-time and have a record of it. Of course, you may end up taking the simple path of letting a child use your old iPhone as an iPod Touch. Keep in mind that the phone can still dial 911, even if it does not have cellular service, Smith said. You can also use your old phone as a back-up in case your new model suffers irreparable harm. That said, the battery of a phone that sits in a drawer unused could drain to the point where it is no longer viable.

At midnight Pacific time, when everyone who wanted to be first to preorder their iPhone 6 or iPhone 6 Plus hit the Apple (AAPL) Store website, they found the door closed. And hours after that, the site was still down, according to the technology website cnet.com. Others sites set to take orders for the latest offering from Apple, T-Mobile (TMUS) and Sprint (S) also had problems dealing with the flood of consumers who want the newest technology as soon as it's available. Those who place preorders through Apple are offered either free shipping or pickup at an Apple retail store. For those who don't want to play the online game, Apple stores are scheduled to begin selling the iPhone 6 at its physical stores at 8 a.m. Sept. 19. Complaints Expressed on Social Media Those trying to get the new phones took to social media to complain that even when they got on an order site that they found certain models and colors unavailable. It was something of an embarrassment for a technology company that was well aware of how many consumers clamor for its devices when they are first released. After the initial feverish burst of interest died down, Apple appeared to get things under control. At about 3 a.m. Pacific time, users reported the site was working and taking orders for all types of phones. Still, some noted that specific colors, like gold, apparently were in such demand that orders are showing delivery dates several weeks out. For in-stock units, buyers can expect to get them on Sept. 19. The iPhone 6 Plus appears to be the most popular offering, with some mobile carriers not offering delivery until mid-October. Apple has had a history of huge demand for its new devices when they're released and has not always been able to keep up with it. With the 2012 release of iPhone 5, Apple couldn't supply enough devices to avoid a sellout on launch day. This time, though, the company has said it has ordered far more devices be built to avoid disappointing those who want to be the first on their block with a new toy.

D Dipasupil/FilmMagicJustin Bieber's Someday perfume. Plenty of stocks go up and down in any given week. The gainers inspire us to keep investing. The decliners keep greed in check while reminding us about the risks of the equity markets. Let's go over some of last week's best and worst performers. China Finance Online (JRJC) -- Up 131 percent last week The market's biggest winner last week was China Finance Online, more than doubling after introducing a new trading platform. The Beijing-based financial website operator announced that the new offering was the country's first integrated, Web-based securities trading service platform. At least one noted worrywart disputed the claim. Citron Research -- a popular publisher of bearish reports on stocks -- tweeted that sloppy reporting and a misleading headline were making it seem as if no other online trading platform existed in the world's most populous nation. The bulls won out. Shares of China Finance Online closed sharply higher in each of last week's five trading days. TrueCar (TRUE) -- Up 33 percent last week Closer to home, another online platform moved nicely higher after striking a deal with Chrysler and auto insurer GEICO (BRK-A). TrueCar operates a negotiation-free car buying and selling platform. It launched a platform that could shake up the insurance industry, where roughly 3 million cars are totaled each year. Insurers have typically just written a settlement check and provided a rental car voucher to cover the incident, but TrueCar's new plan would work with launch partners GEICO and Chrysler -- and other members of its insurance affinity partners in the future -- to work with the insured to directly replace the vehicle. TrueCar went public at $9 just three months ago. The stock has been revving higher, going on to more than double in its brief time on the market. American Eagle Outfitters (AEO) -- Up 26 percent last week Shares of American Eagle Outfitters moved higher after it posted better than expected quarterly results. The clothing retailer may not have had a strong quarter in a absolute terms. Revenue declined 2 percent, as new stores helped partly offset a 7 percent slide in comparable-store sales. Earnings also took a hit, falling from 10 cents a share a year earlier to 3 cents a share this time around. However, it's all about expectations on Wall Street. Analysts were only forecasting American Eagle Outfitters to break even for the period. Elizabeth Arden (RDEN) -- Down 16 percent last week The maker of beauty care products could probably use a makeover after its latest quarter. Sales plunged 28 percent, and Elizabeth Arden blamed the plunge in demand for its celebrity-licensed fragrances. Sorry, Justin Bieber and Taylor Swift fans. Those perfumes just aren't selling these days. Sluggish sales resulted in Elizabeth Arden posting a much wider loss than Wall Street was expecting. Let's bottle it and call it Eau de Disappointment. Oncothyreon (ONTY) -- Down 16 percent last week Oncothyeron joined Elizabeth Arden as Nasdaq's two biggest losers this past week. The biotech took a hit after its once-promising experimental lung cancer treatment failed to show its effectiveness in a clinical trial overseas. Concerned about what the failure means for Onothyeron future, Wedbush Securities slashed its price target for the stock in half. Coupons.com (COUP) -- Down 13 percent last week Things continue to get worse for Coupons.com. Investors have been bailing on the Web-based coupon specialist since posting uninspiring financial results earlier this month. Coupons.com posted a loss of 9 cents a share in its latest quarter, worse than the 5 cents a share deficit that analysts were targeting. Coupons.com went public at $16 in March, but the stock is now trading well below its initial price. More from Rick Aristotle Munarriz D Dipasupil/FilmMagicJustin Bieber's Someday perfume. Plenty of stocks go up and down in any given week. The gainers inspire us to keep investing. The decliners keep greed in check while reminding us about the risks of the equity markets. Let's go over some of last week's best and worst performers. China Finance Online (JRJC) -- Up 131 percent last week The market's biggest winner last week was China Finance Online, more than doubling after introducing a new trading platform. The Beijing-based financial website operator announced that the new offering was the country's first integrated, Web-based securities trading service platform. At least one noted worrywart disputed the claim. Citron Research -- a popular publisher of bearish reports on stocks -- tweeted that sloppy reporting and a misleading headline were making it seem as if no other online trading platform existed in the world's most populous nation. The bulls won out. Shares of China Finance Online closed sharply higher in each of last week's five trading days. TrueCar (TRUE) -- Up 33 percent last week Closer to home, another online platform moved nicely higher after striking a deal with Chrysler and auto insurer GEICO (BRK-A). TrueCar operates a negotiation-free car buying and selling platform. It launched a platform that could shake up the insurance industry, where roughly 3 million cars are totaled each year. Insurers have typically just written a settlement check and provided a rental car voucher to cover the incident, but TrueCar's new plan would work with launch partners GEICO and Chrysler -- and other members of its insurance affinity partners in the future -- to work with the insured to directly replace the vehicle. TrueCar went public at $9 just three months ago. The stock has been revving higher, going on to more than double in its brief time on the market. American Eagle Outfitters (AEO) -- Up 26 percent last week Shares of American Eagle Outfitters moved higher after it posted better than expected quarterly results. The clothing retailer may not have had a strong quarter in a absolute terms. Revenue declined 2 percent, as new stores helped partly offset a 7 percent slide in comparable-store sales. Earnings also took a hit, falling from 10 cents a share a year earlier to 3 cents a share this time around. However, it's all about expectations on Wall Street. Analysts were only forecasting American Eagle Outfitters to break even for the period. Elizabeth Arden (RDEN) -- Down 16 percent last week The maker of beauty care products could probably use a makeover after its latest quarter. Sales plunged 28 percent, and Elizabeth Arden blamed the plunge in demand for its celebrity-licensed fragrances. Sorry, Justin Bieber and Taylor Swift fans. Those perfumes just aren't selling these days. Sluggish sales resulted in Elizabeth Arden posting a much wider loss than Wall Street was expecting. Let's bottle it and call it Eau de Disappointment. Oncothyreon (ONTY) -- Down 16 percent last week Oncothyeron joined Elizabeth Arden as Nasdaq's two biggest losers this past week. The biotech took a hit after its once-promising experimental lung cancer treatment failed to show its effectiveness in a clinical trial overseas. Concerned about what the failure means for Onothyeron future, Wedbush Securities slashed its price target for the stock in half. Coupons.com (COUP) -- Down 13 percent last week Things continue to get worse for Coupons.com. Investors have been bailing on the Web-based coupon specialist since posting uninspiring financial results earlier this month. Coupons.com posted a loss of 9 cents a share in its latest quarter, worse than the 5 cents a share deficit that analysts were targeting. Coupons.com went public at $16 in March, but the stock is now trading well below its initial price. More from Rick Aristotle Munarriz

•5 Shows Netflix Hopes Will Be the New 'Orange Is the New Black' •Wall Street This Week: Inspiring Food, Uninspiring Fashion •Good-for-You Food Can't Cut It at Fast Food Chains

Related FDX Earnings Expectations For The Week Of June 16: FedEx, Oracle And More Benzinga Weekly Preview: New Amazon Smartphone Makes Its Debut UPS to Charge By Package Size (Fox Business) Related ADBE Adobe Shoots Higher On Q2 Report, Guidance Market Wrap For June 17: Markets Higher Ahead Of Fed Decision World Cup Deemed Most 'Social' Sporting Event Ever (Fox Business) Some of the stocks that may grab investor focus today are: Wall Street expects FedEx (NYSE: FDX) to report its Q4 earnings at $2.36 per share on revenue of $11.66 billion. FedEx shares fell 0.08% to $140.20 in after-hours trading. Adobe Systems (NASDAQ: ADBE) reported stronger-than-expected second-quarter earnings. Adobe reported its adjusted earnings of $0.37 per share, beating analysts' estimates of $0.30 per share. Adobe shares climbed 9.42% to $73.90 in the after-hours trading session. Analysts are expecting Red Hat (NYSE: RHT) to have earned $0.33 per share on revenue of $413.98 million in the first quarter. Red Hat shares gained 0.51% to $52.70 in after-hours trading. La-Z-Boy (NYSE: LZB) reported downbeat fourth-quarter revenue. The company also announced its plans to stop production at Hudson plant this year. Its same-store sales declined 0.9% in the quarter, versus an 11.2% gain in the year-ago quarter. La-Z-Boy shares slipped 10.71% to $22.18 in the after-hours trading session. Jabil Circuit (NYSE: JBL) is projected to post a Q3 loss at $0.09 per share on revenue of $3.60 billion. Jabil Circuit shares rose 0.15% to $20.00 in after-hours trading. Analysts expect Actuant (NYSE: ATU) to report its Q3 earnings at $0.63 per share on revenue of $376.57 million. Actuant shares gained 0.83% to close at $36.30 yesterday. Posted-In: Stocks To WatchEarnings News Pre-Market Outlook Markets Trading Ideas © 2014 Benzinga.com. Benzinga does not provide investment advice. All rights reserved. Most Popular Why Tesla Is Up Over 8% Tesla Stock Gains On Patent Sharing News - Analyst Blog Google Glass Rapidly Gaining Traction With Physicians Trulia Rumored To Acquire Move Wall Street Comfortable With Covidien Buy; Some See Move By Johnson & Johnson 4 Top Restaurant Stocks For The Rest Of 2014 Related Articles (ADBE + ATU) Stocks To Watch For June 18, 2014 Adobe Shoots Higher On Q2 Report, Guidance Market Wrap For June 17: Markets Higher Ahead Of Fed Decision The FOMC Meeting And What Low Rates Really Mean Adobe Systems Q2 2014 Earnings Preview #PreMarket Primer: Tuesday, June 17: US Considering Air Strikes In Iraq

For the past week, the news about the news media, quite understandably, has been dominated by the botched firing of New York Times executive editor Jill Abramson and its toxic aftermath. But there's also some other New York Times news that has great significance for the future of the embattled newspaper business in the digital age. The Times' report on innovation, put together by a task force headed by A.G. Sulzberger, son of the newspaper's besieged publisher, has implications that resonate far beyond the Times' midtown Manhattan redoubt. It's must reading for newspaper executives and staffers across the country, and for everyone who cares about journalism. The ambitious report, posted last week by BuzzFeed, finds that the Times is lagging dangerously when it comes to adapting to the digital future. More broadly, it also shines a bright beacon on the severe challenges facing an entrenched business threatened by massive disruption. The report makes clear how hard it is for people and institutions to change what they have been doing for years, regardless of the perceived need to do things differently and the rhetoric that accompanies it. And it underscores how difficult it is for established players to compete with nimble new foes unencumbered by the weight of tradition. The Times has made some great strides in the realm of digital journalism. Its treatment of Snow Fall, its riveting account of a fatal avalanche in Washington state, was a brilliant example of taking advantage of the attributes of the digital platform. But in many ways, the report states forcefully, the news outlet is hamstrung by its inability to shed the obsession with print habits and customs. A disproportionate amount of time, energy and thinking, for example, is spent on the front page of the next day's newspaper while news is exploding 24/7. The Times' website is organized around print sections. There is no way to exaggerate the cataclysmic impact the Internet has had on the newspaper industr! y, once made up largely of monopoly businesses with stratospheric profit margins,  Jill Abramson, former executive editor at the New York Times during commencement ceremonies for Wake Forest University May 19.(Photo: Chris Keane, Getty Images) As is often the case with disruptive challenges, the initial industry instinct was to dismiss the Web, to minimize its ramifications, to write it off as a fad. When it became clear that the digital realm was here to stay, the response too often was to take material from the print product and simply dump it onto the web, completely ignoring the differences between the platforms. There was the deep-seated tendency to hold exclusive stories for print rather than posting them when they were available, for fear of "scooping yourself." That seems awfully quaint today. We've obviously come a long way. But not nearly far enough. As the Innovation Report states, true transformation into a digital-first entity remains elusive at the Times -- and that's true elsewhere in the financially challenged industry. (The report cites a number of news outlets that it says are making strong digital strides, including digital natives BuzzFeed and The Huffington Post and legacy outfits such as USA TODAY and the Financial Times.) The tendency at good newspapers traditionally has been to massage stories until they are airtight, and this predilection is mirrored on the business side. Before launching a new initiative, a legacy news outlet wants to make sure it's in tiptop shape. At a start-up, the instinct is to get the thing launched, work on getting it to the "good enough" stage and take it from there. BuzzFeed's evolution is a perfect illustration of that model. The legacy instinct is commendable, but a for! midable h! andicap in today's hyperquick media environment. Similarly, the tech world's determination to experiment, its willingness to "fail often, fail quickly," is anathema at more established businesses. The situation is complicated by the fact that while the media world is evolving quickly, and while advertising revenue has dropped at an alarming rate, newspapers still make the bulk of their money from print. One of the report's key recommendations is creation of a special digital strategy team that could focus entirely on reinvention for the future without the powerful distraction of daily news demands. It's a good idea. Newspapers across the country would be wise to heed the report's message and redouble (or retriple) their efforts to forge a powerful, truly digital-first approach. Their survival depends on it.

Manning & Napier is an investment fund that provides investment solutions through various means such as managed accounts, mutual funds and collective investment trust funds. The fund was founded in 1970 and as of June 30, 2013, the fund managed $46.3 billion in client assets. Manning & Napier recently released their first quarter portfolio which highlighted 81 new stock buys. As of the close of the first quarter the fund holds on to 372 stocks valued at $24.237 billion. The following five companies represent Manning & Napier's top five portfolio holdings as of the close of the first quarter. Schlumberger NV (SLB) Manning & Napier Advisors' largest position is in Schlumberger where they maintain 8,882,428 shares. Their position in Schlumberger represents 3.6% of their total portfolio and 0.67% of the company's shares outstanding. During the first quarter the fund made a reduction of -3.32% by selling 305,133 shares of the company's stock. They sold these shares in the first quarter price range of $86.16 to $97.96, with an estimated quarterly price of $90.27. Since then the price per share is up approximately 13.1%. Manning & Napier's historical holding history:

Schlumberger NV is a supplier of technology, integrated project management and information solutions to customers working in the oil and gas industry worldwide. Schlumberger's historical revenue and net income:

The analysis on Schlumberger reports that the company's dividend yield is at a 2-year low, the company has issued $5.2 billion of debt over the past three years and they've shown predictable revenue and earnings growth. The Peter Lynch Chart suggests that the company is currently overvalued:

Schlumberger NV has a market cap of $134.15 billion. Its shares are currently trading at around $102.61 with a P/E ratio of 20.20, a P/S ratio of 2.90 and a P/B ratio of 3.40. The company had an annual average earnings growth of 12.10% over the past ten years. GuruFocus rated Schlumberger the business predictability rank of 3-star. Hess (HES) Manning & Napier's second largest holding is in Hess Corp where the fund holds on to 9,529,403 shares of the company's stock. This position makes up for 3.3% of the fund's total portfolio and 2.78% of the company's shares outstanding. During the first quarter Manning & Napier cut their position in Hess -14.04% by selling a total of 1,556,257 shares. They sold these shares in the first quarter price range of $73.92 to $83.96, with an estimated average quarterly price of $79.40. Since then the price per share has increased approximately 10.8%. Manning & Napier's historical holding history:

Hess and its subsidiaries is a global integrated energy company that operates in two segments: Exploration and Production (E&P) and Marketing and Refining (M&R). The E&P segment explores for, develops, produces, purchases and sells crude oil and natural gas. The M&R segment purchases, markets and trades refined petroleum products, natural gases and electricity. Hess' historical revenue and net income:

The analysis on Hess reports that the price is near a 5-year high, it has issued $1.1 billion of debt over the past three years and the company is in a healthy situation according to its Piotroski F-Score. The Peter Lynch Chart suggests that the company is currently undervalued:

Hess has a market cap of $28.66 billion. Its shares are currently trading at around $88.11 with a P/E ratio of 5.90, a P/S ratio of 1.20 and a P/B ratio of 1.20. The company had an annual average earnings growth of 6.80% over the past ten years. EMC Corp (EMC) The fund's third largest holding is in EMC Corp where they hold 24,589,207 shares as of the close of the first quarter. Their position represents 2.8% of their total portfolio and 1.18% of the company's shares outstanding. Manning & Napier decreased their holdings over the first quarter. In doing so they sold a total of 6,445,609 shares of the company's stock in the first quarter price range of $23.66 to $28.18. Since then the price per share is trading up about 4.2%. The fund's historical holding history:

EMC and its subsidiaries develop, deliver and support the Information Technology industry's a range of information infrastructure and virtual infrastructure technologies and solutions. EMC's historical revenue and net income:

The analysis on EMC reports that the company's revenue has slowed down over the past year, they have issued $3.7 billion of debt over the past three years and its operating margin is expanding. The Peter Lynch Chart suggests that the company is currently overvalued:

EMC Corporation has a market cap of $54.55 billion. Its shares are currently trading at around $26.93 with a P/E ratio of 20.20, a P/S ratio of 2.50 and a P/B ratio of 2.50. The company had an annual average earnings growth of 14.50% over the past ten years. GuruFocus rated EMC Corp the business predictability rank of 4-star. Unilever PLC (UL) Manning & Napier's fourth largest holding is in Unilever. The guru holds on to 14,960,937 shares of Unilever, representing 2.6% of their total holdings and 0.49% of the company's shares outstanding. Over the past quarter, Manning & Napier increased their position 2.05% by purchasing 300,462 shares. They purchased these shares in the first quarter price range of $37.85 to $42.62, with an estimated average quarterly price of $39.78. Since then the price per share has increased approximately 10.1%. Manning & Napier's historical holding history:

Unilever PLC is a supplier of fast moving consumer goods. Its four principal areas of operations are: Personal Care, Home Care, Foods and Refreshment. Unilever's historical revenue and earnings growth:

The analysis on Unilever reports that the company's price is near a 10-year high, it has issued £1.1 billion of debt over the past year and its inventory has been building up recently, meaning that the company might be having difficulty selling its product. The Peter Lynch Chart suggests that Unilever is currently overvalued:

Unilever PLC has a market cap of $133.31. Its shares are currently trading at around $44.07 with a P/E ratio of 19.20, a P/S ratio of 1.90 and a P/B ratio of 6.80. The dividend yield of Unilever stocks is currently at 3.50%. The company had an annual average earnings growth of 2.40% over the past ten years. Encana (ECA) Manning & Napier's fifth largest holding is in Ecana. The guru holds on to 27,376,066 shares of Unilever, representing 2.4% of their total holdings and 3.71% of the company's shares outstanding. Over the past quarter, Manning & Napier increased their position 0.22% by purchasing 60,930 shares. They purchased these shares in the first quarter price range of $17.25 to $21.42, with an estimated average quarterly price of $18.90. Since then the price per share has increased approximately 21.8%. Manning & Napier's historical holding history:

Encana is an energy producer that is focused on growing its strong portfolio of diverse resource plays producing natural gas, oil and NGLs. The company's other operations include the transportation and marketing of natural gas, oil and NGLs. Encana's historical revenue and net income:

The analysis on Encana reports that the company's revenue has been in decline over the past five years, its dividend yield is near a 5-year low and its price is near a 2-year high. The analysis also notes that the company's P/E, P/B and P/S ratios are all near a 1-year high. Check out Manning & Napier's complete first quarter portfolio here. Try a free 7-day premium membership trial. Also check out: Manning & Napier Undervalued Stocks Manning & Napier Top Growth Companies Manning & Napier High Yield stocks, and Stocks that Manning & Napier keeps buying | Currently 0.00/512345 Rating: 0.0/5 (0 votes) | |

Subscribe via Email  Subscribe RSS Comments Please leave your comment: More GuruFocus Links | Latest Guru Picks | Value Strategies | | Warren Buffett Portfolio | Ben Graham Net-Net | | Real Time Picks | Buffett-Munger Screener | | Aggregated Portfolio | Undervalued Predictable | | ETFs, Options | Low P/S Companies | | Insider Trends | 10-Year Financials | | 52-Week Lows | Interactive Charts | | Model Portfolios | DCF Calculator | RSS Feed  | Monthly Newsletters | | The All-In-One Screener | Portfolio Tracking Tool |  MORE GURUFOCUS LINKS | Latest Guru Picks | Value Strategies | | Warren Buffett Portfolio | Ben Graham Net-Net | | Real Time Picks | Buffett-Munger Screener | | Aggregated Portfolio | Undervalued Predictable | | ETFs, Options | Low P/S Companies | | Insider Trends | 10-Year Financials | | 52-Week Lows | Interactive Charts | | Model Portfolios | DCF Calculator | RSS Feed  | Monthly Newsletters | | The All-In-One Screener | Portfolio Tracking Tool | SLB STOCK PRICE CHART  102.03 (1y: +42%) $(function(){var seriesOptions=[],yAxisOptions=[],name='SLB',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1366693200000,71.94],[1366779600000,73.17],[1366866000000,73.44],[1366952400000,73.34],[1367211600000,74.03],[1367298000000,74.43],[1367384400000,73.79],[1367470800000,74.25],[1367557200000,75.72],[1367816400000,76.16],[1367902800000,76.89],[1367989200000,77.59],[1368075600000,77.25],[1368162000000,76.82],[1368421200000,77.04],[1368507600000,76.86],[1368594000000,75.68],[1368680400000,75.27],[1368766800000,75.74],[1369026000000,77.42],[1369112400000,77.08],[1369198800000,75.58],[1369285200000,75.38],[1369371600000,74.66],[1369717200000,75.4],[1369803600000,74.98],[1369890000000,74.81],[1369976400000,73.03],[1370235600000,73.25],[1370322000000,72.85],[1370408400000,72.18],[1370494800000,73.3],[1370581200000,73.93],[1370840400000,73.3],[1370926800000,71.44],[1371013200000,70.95],[1371099600000,72.46],[1371186000000,71.6],[1371445200000,73.1],[1371531600000,74.16],[1371618000000,73.4],[1371704400000,72.14],[1371790800000,72.83],[1372050000000,71.24],[1372136400000,72.09],[1372222800000,71.81],[1372309200000,71.93],[1372395600000,71.66],[1372654800000,72.78],[1372741200000,72.61],[1372827600000,73.01],[1373000400000,74.09],[1373259600000,74.79],[1373346000000,76.54],[1373432400000,76.18],[1373518800000,76.63],[1373605200000,76.84],[1373864400000,77.02],[1373950800000,76.52],[1374037200000,77.61],[1374123600000,78.48],[1374210000000,82.74],[1374469200000,83.81],[1374555600000,83.57],[1374642000000,82.85],[1374728400000,82.57],[1374814800000,81.91],[1375074000000,81.15],[1375160400000,81.43],[1375246800000,81.33],[1375333200000,83.55],[1375419600000,82.89],[1375678800000,82.89],[1375765200000,82.22],[1375851600000,81.05],[1375938000000,81.23],[1376024400000,80.49],[1376283600000,80.25],[1376370000000,82.22],[1376456400000,82.16],[1376542800000,81.99],[1376629200000,81.92],[1376888400000,80.41],[1376974800000,80.62],[1377061200000,80.05],[1377147600000,82.21],[1377234000000,81.67],[! 1377493200000,81.9],[1377579600000,81.17],[1377666000000,82.68],[1377752400000,81.6],[1377838800000,80.94],[1378184400000,82.42],[1378270800000,82.86],[1378357200000,84.22],[1378443600000,85.14],[1378702800000,86.45],[1378789200000,86.9],[1378875600000,87.05],[1378962000000,86.58],[1379048400000,86.72],[1379307600000,87],[1379394000000,87.74],[1379480400000,88.95],[1379566800000,88.79],[1379653200000,87.44],[1379912400000,87.04],[1379998800000,87.91],[1380085200000,88.57],[1380171600000,88.83],[1380258000000,88.82],[1380517200000,88.36],[1380603600000,89.05],[1380690000000,89.85],[1380776400000,89.44],[1380862800000,90.01],[1381122000000,89.29],[1381208400000,87.95],[1381294800000,87.04],[1381381200000,89.42],[1381467600000,90.02],[1381726800000,91.17],[1381813200000,90.54],[1381899600000,92.18],[1381986000000,91.43],[1382072400000,93.99],[1382331600000,93.48],[1382418000000,94.46],[1382504400000,92.84],[1382590800000,92.85],[1382677200000,92.9],[1382936400000,92.85],[1383022800000,94],[1383109200000,93.88],[1383195600000,93.72],[1383282000000,93],[1383544800000,93.51],[1383631200000,92.39],[1383717600000,93.23],[1383804000000,92.05],[1383890400000,93.79],[1384149600000,93.87],[1384236000000,91.99],[1384322400000,93.08],[1384408800000,93.31],[1384495200000,92.98],[1384754400000,92.02],[1384840800000,91.28],[1384927200000,90.45],[1385013600000,91.01],[1385100000000,92.73],[1385359200000,89.81],[1385445600000,89.46],[1385532000000,87.95],[1385704800000,88.42],[1385964000000,87.6],[1386050400000,87.64],[1386136800000,87.28],[1386223200000,86.87],[1386309600000,88.15],[1386568800000,88.03],[1386655200000,87.01],[1386741600000,86.14],[1386828000000,86.96],[1386914400000,86.37],[1387173600000,87],[1387260000000,85.54],[1387346400000,87.26],[1387432800000,86.47],[1387519200000,87.27],[1387778400000,87.32],[1387864800000,88.31],[1388037600000,89.39],[1388124000000,89.9],[1388383200000,89.17],[1388469600000,90.11],[1388642400000,88.82],[1388728800000,88.35],[1388988000000,88.02],[1389074400000,87.51],[1389160800! 000,86.98! ],[1389247200000,86.48],[1389333600000,88.17],[1389592800000,87.46],[1389679200000,88.87],[1389765600000,88.89],[1389852000000,88.61],[1389938400000,90.21],[1390284000000,91.09],[1390370400000,91.21],[1390456800000,90.26],[1390543200000,88.15],[1390802400000,87.91],[1390888800000,87.76],[1390975200000,87.3],[1391061600000,88.81],[1391148000000,87.57],[1391407200000,86.23],[1391493600000,87.19],[1391580000000,86.16],[1391666400000,88.51],[1391752800000,89.5],[1392012000000,89.04],[1392098400000,90.37],[1392184800000,90.03],[1392271200000,90.26],[1392357600000,90.45],[1392703200000,90.63],[1392789600000,90.48],[1392876000000,91.03],[1392962400000,90.07],[1393221600000,92.72],[1393308000000,92.56],[1393394400000,92.35],[1393826400000,91.26],[1393912800000,92.49],[1393999200000,92.01],[1394085600000,92.75],[1394172000000,92.98],[1394427600000,92.87],[1394514000000,91.95],[1394600400000,91.17],[1394686800000,90.27],[1394773200000,89.09],[1395032400000,89.78],[1395118800000,90.5],[1395205200000,90.36],[1395291600000,91.11],[1395378000000,92.67],[1395637200000,93.23],[1395723600000,95.56],[1395810000000,95.43],[1395896400000,96.49],[1395982800000,97.57],[1396328400000,97.96],[1396414800000,97.69],[1396501200000,98.07],[1396587600000,98.03],[1396846800000,97.6],[1396933200000,98.44],[1397019600000,99.02],[1397106000000,97.32],[1397192400000,97.1],[1397451600000,98.48],[1397538000000,100.11],[1397624400000,100.94],[1397710800000,99.91],[1398056400000,101.8],[1398201057000,102.03],[13982

| |

Don't discount the importance of that detail, and its technical ramifications. Logitech International SA has been working on this rebound for months, slowly logging an arc-shaped reversal (the kind that sticks) since late March. As of this week, however, that turnaround effort finally finds the undertow working in its favor.

Don't discount the importance of that detail, and its technical ramifications. Logitech International SA has been working on this rebound for months, slowly logging an arc-shaped reversal (the kind that sticks) since late March. As of this week, however, that turnaround effort finally finds the undertow working in its favor.

Alamy With about 10 million new iPhone 6s ordered in the initial days on the market, a whole lot of old iPhones are destined for the scrap heap. Sure, you could sell, donate or recycle your old iPhone, but you probably won't. And there are better things to do with it. One creative example: At the Missouri University of Science and Technology, a biology class is making old iPhones into microscopes. Using less than $10 worth of supplies, the old phones are mounted onto a lens and can magnify an object to 175 times its size. Even an old phone with a cracked screen can be repurposed, says Josh Smith, editor of GottaBeMobile.com. "You're only really limited by your imagination," Smith says. Here are 10 smart -- and cheap -- uses for old iPhones. Clock Set your old phone on a dock or a stand and use a clock app. With Standard Time ($3.99), you will have a timepiece unlike any other. With this app, your clock is a non-stop time lapse video of construction workers switching out pieces of lumber to shape the actual time. "It's mesmerizing," says Shawn Roberts, 47, an Oakland, California, marketing executive. You can also set up flexible alarms and get the phone to play soothing white noise as you go to sleep. Set it close enough to the bed, and it can be a sleep tracker, too, with an app like SleepBot (free). Music For Your Car Take your music library on the road. Some cars come equipped with docking ports for iPhones and have dashboard screens so you can navigate your musical options hands-free. Or you can just use the cigarette lighter for power. Remote Control Televisions, speakers and other devices now have apps that allow users to make their iPhones into sleek remotes. Carm Lyman, 42, of Napa, California, converted his iPhone 4 into a remote for his household sound system after his iPhone 5 arrived. Lyman can control the audio levels and activate speakers in various parts of his home as well as access different music services. Surveillance System Apps can convert an old iPhone that has access to WiFi into a surveillance camera and motion detector. Presence, which is a free app, provides a live stream from the area you want to monitor. You can set it up to record video clips when it detects motion, too. If you buy a robotic viewing stand for about $100, you can move the camera 360 degrees rather than stick with a stationary view. Cookbook No need to go through recipe books or hunt around for other devices when you have a kitchen iPhone. Download a cookbook app, such as My Recipe Book (99 cents) or Big Oven (free), and just leave the device on the kitchen counter. It takes up almost no space and will hold far more recipes than any book. Extra Storage Need a place to store old photos and music or other files? Turn your old phone into a storage drive using a free app like USB & Wi-Fi Flash Drive. Voice Recorder Why buy a digital voice recorder when you have a retired iPhone? Using any of several free apps, including Voice Recorder and Voice Record Pro, you will have a designated memo recorder or a device to record interviews and speeches. Document Scanner Genius Scan and Doc Scan are two apps that will turn an iPhone into a handy portable scanner that you can use for work, school reports, genealogical research, or recording receipts. And they won't cost you a penny. For $20 and up, you can buy a stand that makes your iPhone into a stationary scanner. Baby Monitor Sure, you can spend $100 or more on a baby monitor, or you can just set your old iPhone up to watch streaming video of your baby as well as hear and even talk to him or her. Cloud Baby Monitor ($3.99) also allows parents to receive the signal on a wireless network or on Wi-Fi so they don't have to be within a certain number of feet of the monitor. Vehicle Tracker Whether you need to find your car if it is stolen, record where you have traveled, or spy on your teenage driver, the built-in GPS in your phone can be used as a tracking device. An app like InstaMapper ($2.99) lets you watch the vehicle in real-time and have a record of it. Of course, you may end up taking the simple path of letting a child use your old iPhone as an iPod Touch. Keep in mind that the phone can still dial 911, even if it does not have cellular service, Smith said. You can also use your old phone as a back-up in case your new model suffers irreparable harm. That said, the battery of a phone that sits in a drawer unused could drain to the point where it is no longer viable.