| Carlyle Gaming (CGME) | Summer Wind | BO | 6,127,000 | 4,350,170 | | Pimco Dyn Cr Inc (PCI) | Gross W | O | 123,800 | 2,728,080 |

Kids born in 1946 — the beginning of the baby boom generation — gathered around their TV sets to watch the Mickey Mouse Club, Leave it to Beaver and Howdy Doody. The kids born at the tail end of the boom, in 1964, tuned into Scooby Doo, Super Friends and Little House on the Prairie. Early and late boomers have widely varied cultural perspectives and life experience — so advisors lump them together at their peril, the Insured Retirement Institute warns. While their differences are not as pronounced as the gap between boomers and millennials, younger boomers will likely face additional challenges, according to an IRI report released Monday. Overall, just 34% of boomers said they were confident in their ability to retire comfortably, the report found. However, older boomers, those between ages 61 and 66, were more confident, with 42% saying they could retire comfortably. Just 25% of boomers between ages 50 and 55 agreed. It doesn’t hurt that early boomers are more likely to have retired already, making retirement a reality instead of a vague unknown. “From a retirement planning perspective, we need to start segmenting the boomer cohort to ensure that we are appropriately addressing their unique retirement needs and challenges,” Cathy Weatherford, IRI president and CEO, said in a statement. “Those on the back end of the generation have had a much different workplace experience than the first boomers.” Weatherford noted that unlike many early boomers who likely have pension plans, younger boomers were more likely to spend most of their careers in the defined contribution plan era and “will face many of the risks and challenges that have come with it. As a result they will be more self-responsible for their retirement income security. At the same time, late boomers have less saved for retirement and their low confidence regarding their future financial security reflects this.” Furthermore, early boomers worked through long spells of economic stability, giving them a leg up on retirement security, according to the report. Indeed, the Pew Charitable Trust found in May that early boomers may be the last generational cohort to retire well. Almost a third of early boomers say they have less than $100,000 saved for retirement, but nearly half of late boomers said they have less than that saved, IRI found. Just over a quarter of late boomers said they are doing a good job preparing for retirement, compared with 45% of early boomers. Late boomers are also more likely to struggle with day-to-day expenses or support adult children financially. Almost a third said they were having trouble paying their mortgage or rent, compared with 20% of early boomers. Thirty-four percent of younger boomers say they are providing financial support for adult children, compared with 21% of older boomers. Social Security is another challenge weighing unevenly on late boomers. Over half of early boomers expect Social Security to be a major source of income in retirement, compared with just 36% of late boomers. Despite all these challenges, 41% of late boomers expect their financial situation will improve over the next five years, compared with 25% of early boomers. IRI theorized that this is likely because they still have a few years left in the work force. “Part of the explanation of this greater optimism among late boomers could be more late boomers are working with at least 12 more years until full Social Security eligibility for the oldest in this cohort, the 55-year-olds. More working years provides more opportunity to improve upon current financial challenges,” according to the report. Furthermore, according to the Bureau of Labor Statistics, unemployment for people between 50 and 54 was under 6% in May, down from 7.2% in 2009. --- Check out Early Boomers May Be Last Generation on Track to Retire Well on AdvisorOne.

VIVUS, Inc. (VVUS) recently announced that it has entered into a license and commercialization in addition to a supply agreement for its erectile dysfunction (ED) drug, Spedra, with privately-held Italian pharmaceutical company, Menarini. Investors reacted positively to the news. As per the terms of the agreement, Menarini will get the rights to Spedra in more than 40 European countries, apart from Australia and New Zealand. In exchange VIVUS will get an upfront payment of approximately $21 million and approximately $30 million in the first year. VIVUS will also be eligible to receive milestone and other payments of approximately $102 million, depending upon certain pre-specified criteria. Additionally, the company will get royalties on net sales of Spedra from Menarini. VIVUS and Menarini also entered into a supply agreement for Spedra, according to which VIVUS will supply the product to the latter. The partnership on Spedra, a phosphodiesterase type 5 (PDE5) inhibitor, will not only boost VIVUS' balance sheet but also go a long way in removing uncertainties related to the drug's launch in those territories. We remind investors that the European Commission (EC) cleared Spedra, for ED, in the EU in Jun 2013. The approval did not come as a surprise as, in Apr 2013, the European Medicines Agency's (EMA) Committee for Medicinal Products for Human Use (CHMP) recommended the approval of the drug. The approval came on the basis of promising data from three phase III trials, REVIVE, REVIVE-Diabetes and REVIVE-RP, and a year-long safety study. We note that the US Food and Drug Administration (FDA) approved the drug under the trade name Stendra for ED in April last year. VIVUS is looking for a partner in the US to market the drug. We note that a few days back VIVUS announced encouraging data from a multi-center, placebo-controlled study (TA-501) evaluating the efficacy of Stendra in men suffering from ED. The study enrolled 440 patients with mi! ld-to-severe ED with or without diabetes. Data from the study revealed that on an average Stendra was effective after 10 minutes and 12 minutes of taking the 200 mg and 100 mg formulation of the drug, respectively. According to the company, ED therapies recorded combined sales of over $5.5 billion in 2012. The ED market is expected to grow further in the coming years. Currently approved PDE5 inhibitors including Pfizer Inc.'s (PFE) Viagra and Eli Lilly and Company's (LLY) Cialis are recommended for ingestion one to two hours prior to sexual activity or daily. We believe Stendra's fast action could help the drug gain share once launched. VIVUS currently carries a Zacks Rank #3 (Hold). Companies that currently look attractive include Santarus, Inc. (SNTS) with a Zacks Rank #1 (Strong Buy).

Rentech (RTK) is seeing estimates for 2013 slide deeper and as a result it is a Zacks Rank #5 (Strong Sell). It is the Bear of the Day.Moving to the NASDAQ Capital MarketYesterday, the company announced that it will transfer its listing from the NYSE to the NASDAQ Capital Market effective with the start of trading on August 13, 2013. Rentech will continue to trade under its existing ticker symbol "RTK." Rentech's common stock will trade on the NYSE MKT until the close of trading on August 12, 2013.Company DescriptionRentech engages in the sale of natural-gas based nitrogen fertilizer products in the United States and Brazil. Its products include ammonium sulfate, sulfuric acid, and ammonium thiosulfate used in the production of corn, soybeans, potatoes, cotton, canola, alfalfa, and wheat. Rentech, Inc. was founded in 1980 and is based in Los Angeles, California.Earnings HistoryOver the last six earnings reports, the RTK hasn't done so well. I see one beat in for the September 2012 quarter. There were two earnings meets and three earnings misses.Two of the three earnings misses have been the last two reported quarters. The negative earnings surprises both came with Wall Street looking for the company to report either a gain or a breakeven quarter, and both times the company reported a loss in the quarter.Earnings Estimates Not GrowingEstimates for RTK have declined of late. The 2013 estimates are moving lower, but not by that much. Peaking at $0.14 in March they have ticked lower to $0.07 in April. They have since slide to $0.02.The 2014 Zacks Consensus Estimate seen a more dramatic collapse, with estimates moving from $0.26 in June to $0.14 at the current level.ValuationThe valuation picture for RTK is off the charts. By off the charts I mean that the industry averages are negative, not allowing for a proper comparison. Still the 107X trailing PE is huge, but bigger still is the 142.7x forward PE. The Price to book multiple of 2.6x is a good sized premium to the industry average of 1.9x. The ! price to sales metric has the company trading at 1.7x vs the 1.1x for the industry. The Chart The price and consensus chart really tells the story here as the estimate lines for 2013 and 2014 have recently taken a nosedive. That dive lower in estimates comes a little after the stock fell from $3 to $2.25. The problem is, estimates may still fall further, which will lead to lower stock prices.  Brian Bolan is a Stock Strategist for Zacks.com. He is the Editor in charge of the Zacks Home Run Investor service, a Buy and Hold service where he recommends the stocks in the portfolio.Brian is also the editor of Breakout Growth Trader a trading service that focuses on small cap stocks and also carries a risk limiting strategy. Subscribers get daily emails along with buy, and sell alerts.Follow Brian Bolan on twitter at @BBolan1Like Brian Bolan on Facebook

BALTIMORE (Stockpickr) -- Put down the 10-K filings and the stock screeners. It's time to take a break from the traditional methods of generating investment ideas. Instead, let the crowd do it for you. From hedge funds to individual investors, scores of market participants are turning to social media to figure out which stocks are worth watching. It's a concept that's known as "crowdsourcing," and it uses the masses to identify emerging trends in the market. Crowdsourcing has long been a popular tool for the advertising industry, but it also makes a lot of sense as an investment tool. After all, the market is completely driven by the supply and demand, so it can be valuable to see what names are trending among the crowd. While some fund managers are already trying to leverage social media resources like Twitter to find algorithmic trading opportunities, for most investors, crowdsourcing works best as a starting point for investors who want a starting point in their analysis. Today, we'll leverage the power of the crowd to take a look at some of the most active stocks on the market today. These "most active" names are the most heavily-traded names on the market -- and often, uber-active names have some sort of a technical or fundamental catalyst driving investors' attention on shares. That's especially true now that earnings season is officially underway. And when there's a big catalyst, there's often a trading opportunity. Without further ado, here's a look at today's stocks. Potash Nearest Resistance: $37

Nearest Support: $29

Catalyst: Industry Insanity It's been quite a week for Potash (POT). Shares of the $26 billion firm are up 1% on high volume today after dropping more than 20% from Monday's open. The whole fertilizer industry is getting shaken up after Russia-based Uralkali ended a joint venture with Belaruskali that controlled around 43% of the potash market. With lower potash prices looking imminent, the whole industry is getting shellacked this week. POT is just one of the more high profile movers. Today, shares of POT are trying to establish support on high trading volume. That level looks pretty strong at $29. With support so near by, and resistance well overhead and $37, August could be a good time to start building a position in POT. I'd recommend waiting for a more meaningful move off of $29 first. Sprint Nearest Resistance: $6.80

Nearest Support: $5.60

Catalyst: Earnings Sprint (S) is getting a 6% shot in the arm this afternoon, following earnings numbers that forecast a return to subscriber growth after losing names for the last seven months straight. Despite taking a big hit from winding down its Nextel unit during the quarter, Sprint is looking stronger now that Japan's Softbank owns 78% of shares. Wall Street's reaction to the earnings release is evidence of that. From a technical standpoint, there are probably more questions than answers on Sprint's chart. Shares are currently sitting in between resistance at $6.80 and support down at $5.60. Despite today's big boost, shares are still trading in the middle of that range. Until Sprint can resolve a direction, I'd recommend staying away. J.C. Penney Nearest Resistance: $16

Nearest Support: $14

Catalyst: Credit Rebuttal Shares of retail giant J.C. Penney (JCP) are finding some buoyancy again after dropping double digits in yesterday's session. The trigger was news that commercial lender CIT Group was starting to cut off credit to some of Penney's suppliers -- a major vote of concern for JCP's ability to pay its bills. Management refuted the claims today, boosting shares by 2.5%. This stock is still down considerably on the week. Penney's drop is less concerning than it would be if shares had dropped below an important technical level. Instead, $14 still looks like strong support in JCP. That's not to say that shares look especially bullish from here -- the stock is still in a downtrend since its May highs. Even so, it doesn't look like the floor is going to fall out from here. To see these stocks in action, check out the at Most-Active Stocks portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

LONDON -- Imagination Technologies (LSE: IMG ) , the graphic processing-focused rival to ARM Holdings (LSE: ARM ) (NASDAQ: ARMH ) , reported strong growth in the number of devices -- mobile phones, tablets, and smart TVs -- shipped containing the company's chip designs. Units jumped from 325 million to 535 million last year. This progress puts the company well on its way to its (once seemingly audacious) goal of having 1 billion items with its intellectual property ship in a single year by 2016. As a result, royalty revenue increased 49% to 89.5 million pounds and total revenue was up 19% to 151.5 million pounds. However, heavy investment in staff, facilities, and research into new technologies resulted in a dramatic increase in operating expenses and pulled operating profit down 13%. What's a billion between friends?

The company's shares tumbled in early May after management revealed license revenue was going to be weaker than expected this year. Similar to ARM, Imagination doesn't physically build chips. Its research and development teams design the chips and then license those designs to partners like Apple, Samsung, LG, and Intel (Intel and Apple own 15% and 9% of Imagination, respectively) to use in their products. Then Imagination gets paid every time one of those products is sold (currently about 17 pence per). So license revenue is a bit of a look-ahead indicator for future revenue and if Imagination is having trouble signing new license agreements, achieving that 1 billion target could be tricky. With a price-to-earnings multiple of 41, it would appear the market is looking for some serious growth so missing that target would be painful. Management thinks the drop in license revenue is temporary and the result of the weaker global economy and some short-term industry trends, but they would say that, wouldn't they? New(ish) kid on the block

One reason to wonder if there is more to the drop in license revenue than management says is that ARM, which is known mainly for central processing units as opposed to Imagination's graphics processing units and dominates the mobile phone chip market, has been winning market share in the graphics market with its Mali chip. While Apple's iPad uses Imagination chips, many cheaper Android tablets use the Mali chip which has given ARM a boost in the tablet game as more and more low-end tablets hit the market. To answer this challenge, Imagination bought troubled CPU designer MIPS earlier this year in an attempt to boost the company's CPU development and hopefully gain access to some new clients and markets. Virtual land grab

The world is becoming more connected and mobile computing (via smartphones, tablets, wearable devices) is growing rapidly. We're also approaching the age of the Internet of Things (where your refrigerator talks to your car to let you know you need to stop at the grocery store for milk and your thermostat tells the utility company you don't need as much power because you're on vacation), which means there is likely to be immense demand for the combination of powerful computing capability and low energy consumption that are hallmarks of the ARM and Imagination chip designs. ARM won the first round with its dominance in mobile phones. Imagination notched a nice win with its presence in Apple devices. Where we go from here could be interesting -- for consumers and investors. I don't pretend to know what the future holds, but I'm pretty certain Imagination investors are in for some exciting times. If you like a little more certainty in your future, why not check out this exclusive wealth report from The Motley Fool? It's free! Just click here for the report.

In a press release last week, NVIDIA (NASDAQ: NVDA ) announced the latest expansion of its cloud-based graphics services with the integration of its GRID virtual GPU into Citrix's (NASDAQ: CTXS ) XenDesktop 7. So what, exactly, does this mean? For those of you who are unfamiliar, Citrix provides intuitive cloud and networking technologies, including popular solutions such as GoToMeeting and CloudPortal, and virtualization solutions including XenApp, XenDesktop, and XenServer. XenDesktop, for its part, gives IT departments an intuitive, secure way to provide central access to Windows apps and desktops as a mobile "on-demand service for any user, anywhere, and on any device." The problem

However, for anyone who has ever tried to run a remote desktop session using any given virtualization client, you're probably aware that remote graphics are typically less than satisfactory. After all, given the large amount of data required to stream display information across a simple network connection, users have simply grown accustomed to dealing with jumpy, unresponsive screens while using virtual desktops over the years. As NVIDIA puts it, "the user experience until now had been constrained by the subpar performance and limited compatibility of software-emulated graphics." NVIDIA's solution

That's exactly where the bright minds at NVIDIA come into play. Through their GRID vGPU, multiple XenDesktop users can now "directly access the graphics processing power of a single GPU." But seeing is believing, right? So take a look, then, at the performance increase realized through NVIDIA's GRID vGPU for designers using SolidWorks 3D CAD software through XenDesktop: To be sure, the difference couldn't be more apparent, and it's hard to imagine a scenario in cases like this where the productivity increases alone wouldn't quickly pay for the added cost of using GRID vGPUs. Larger by the day

But don't lose sight of the bigger picture, either; this news is yet another step toward NVIDIA's longer-term goal of making GRID an ever-present part of our everyday lives. As I noted in March, NVIDIA's new rack-mountable Visual Computing Appliance should go a long way toward winning the hearts of IT departments in the substantial small and medium business segment. Better yet, NVIDIA also has huge cloud-based plans to use GRID to permeate the $68 billion gaming market, starting with the Project Shield mobile gaming device. In the end, given the world's increasing reliance on virtualized software along with our simultaneous insistence on decent graphics, it's a safe bet solutions like these are just the tip of the iceberg for NVIDIA. Personally, this stands as yet another of many reasons I plan on holding my shares of NVIDIA for a very, very long time. NVIDIA was ahead of the curve launching its mobile Tegra processor, but investing gains haven't followed as expected, with the company struggling to gain momentum in the smartphone market. The Motley Fool's brand-new premium report examines NVIDIA's stumbling blocks, but also homes in on opportunities that many investors are overlooking. We'll help you sort fact from fiction to determine whether NVIDIA is a buy at today's prices. Simply click here now to unlock your copy of this comprehensive report.

Click for more market data. NEW YORK (CNNMoney) Good news is good news! Stocks bounced back Friday thanks to a much better-than-expected jobs report. The Dow Jones industrial average rose more than 110 points, or 0.7%, while the S&P 500 and the Nasdaq were each up over 1%. This comes one day after stocks tumbled following a surprise interest rate cut by the European Central Bank and stronger than expected U.S. economic reports. The S&P 500 and the Dow are on track to end higher for a fifth straight week. The Nasdaq, despite Friday's big gains, is still down for the week. The economy added 204,000 jobs in October, according to the Labor Department. That is higher than the 120,000 estimate of economists surveyed by CNNMoney. The gains came despite a partial government shutdown in October, which many economists had feared would hurt the economy. Separately, the Commerce Department said personal income rose 0.5% in September, while spending edged up 0.2%. But consumer sentiment was down in October, according to an index from Reuters and the University of Michigan. Still, Friday's jobs report and other good economic news has revived speculation on when the Federal Reserve will begin scaling back, or tapering, its $85 billion per month bond buying program. Many market experts believe the Fed's stimulus is a key reason why stocks have surged this year. But bond prices fell, with the yield on the 10-year Treasury note rising to 2.75%, from 2.61% Thursday. Bond prices and rates move in opposite directions. The spike in yields Friday could be another sign that the market believes the Fed will taper sooner rather than later. Alan Levenson, an economist at T. Rowe Price Associates, said the jobs report increases the chance that the Fed could announce it will start to taper at its December meeting. Yields surged earlier this summer on expectations the Fed would cut back its bond buying sometime this year. But not everyone believes the Fed will make a move next month. Hank Smith, chief investment officer at Haverford Trust, said many investors are still looking for tapering to begin early next year once a new Fed chairman is in place. Current Fed chair Ben Bernanke's term is set to expire at the end of January. President Obama has nominated Fed vice chair Janet Yellen to replace him. She must still be confirmed by the Senate. But even when the tapering process ! begins, monetary policy is likely to remain "extraordinarily accommodative," said Smith. Stocks on the move: Twitter (TWTR) shares were down 5% on Friday, their second day of trading. Twitter shares closed at $44.90 on Thursday, a whopping 73% gain from its initial public offering price of $26 a share. Some StockTwits users were quick to say I told you so. "$TWTR Several of us warned bulls yesterday that the sell-off hadn't even started. Hope you listened," said BlackBerril. Others were relieved that they stayed away from the highly-anticipated IPO. "$TWTR Back to IPO price pretty soon. Whoever held back on buying is probably feeling good about now," said Sanjit69. Still, some traders see Twitter, which is not yet profitable, as an attractive investment at the right price. "$TWTR This stock has nothing but hopes and dreams. I do believe some of their dreams will come true, for now I stay out. Will buy in 20's," said Brwood6980. Shares of the Gap (GPS, Fortune 500) jumped 9% after the apparel retailer reported strong sales for October. That's a sharp contrast with Abercrombie & Fitch (ANF), which warned of weak sales earlier this week and shut down its lingerie business.  Khakis are back! Gap up on strong sales "Khakis are cool again in Oct after being uncool in Sep. $GPS," said bigelam. Groupon (GRPN) shares rose despite disappointing earnings and a weak outlook. The daily deal site announced it was buying Korean site Ticket Monster from its top rival LivingSocial. Walt Disney (DIS, Fortune 500) reported slightly better-than-expected earnings and sales. The stock rose on the news. Tesla (TSLA) shares continued to fall Friday after a Model S caught fire after a crash T! hursday i! n Tennessee. It's the third widely-reported fire involving one of the all-electric plug-in luxury cars in just two months. The stock has plunged more than 20% since it reported its latest quarterly results on Tuesday. European markets ended mixed. The Paris stock market tumbled after Standard & Poor's downgraded France's credit rating. Asian markets chalked up big losses despite strong China trade data.

The Internet is increasingly becoming a larger part of the average Russian's daily life. Based on the prevailing user growth trend, both Internet usage and frequency should increase. The Internet is increasingly becoming a larger part of the average Russian's daily life. Based on the prevailing user growth trend, both Internet usage and frequency should increase.

This is great news for online advertising; as Russia's largest Internet advertising company, Yandex N.V. (YNDX) is well positioned to profit from this expanding market. Yandex is Russia's most popular site with 52 million unique visitors per month. Though every search company is an underdog compared to Google, Yandex has a distinct home field advantage in the search market. Yandex has 62% of the Russian search market while Google controls only 26%.

Yandex revised its sales forecast higher, increasing it to range of 30% to 35% for 2013, even as Russian policy makers cut GDP growth estimates. Management also announced a share repurchase program of up to 12 million shares, which is about 4.5% of the outstanding shares. Financial results for the first quarter ended March 31, 2013 were also positive. Revenues increased 36% to $257 million. Income from operations ballooned 57% to $79 million -- thanks to a 30.7% operating margin -- and net income soared 79% to $72.2 million. Yandex had $942 million in cash at the end of the quarter.

As you can tell, the financial results are very strong. More importantly, management believes that success will continue. The financials should also be supported by the strong tailwinds in online advertising growth and Internet usage rates in Russia. Moreover, Yandex is expanding into other high growth countries. Turkey has a large and fast-growing online audience. Though Yandex has only 2% share of the Turkish search market, 84% of the country's Internet users recognized the Yandex brand. The number of daily Turkish users increased 10-fold to 940,000 during the past year, too. We believe Yandex is a great investment below $31 and predict the stock will rise to $36 this year.

On this day in economic and business history... The New York Stock Exchange -- the larger part of NYSE Euronext (NYSE: NYX ) -- moved into its present home on 18 Broad Street (on the corner of Broad and Wall Street) on April 22, 1903. It was an architectural marvel for its time, with a massive open trading floor without any supporting columns, huge windows, six miles of pneumatic tubes for routing orders, and one of the world's first air-conditioning systems. Even if you've never visited this iconic location, you're probably well-acquainted. It is one of the most famous buildings in the world:

Source: Dave Winer via Flickr.

The Exchange also has one of the most iconic sculptures in the world standing near its doors, called simply Charging Bull. The bronze statue in Bowling Green has become a symbol of New York's financial sector ever since it was installed following the 1987 market crash:

Source: Rob Jamieson via Flickr.

Where else might you have seen the current building? Well, beyond the many market-focused films, you might have seen Bane hijack the "Gotham Stock Exchange" in The Dark Knight Rises. Those scenes were shot in the New York Stock Exchange building. Bane's efforts have been compared to the modus operandi of Occupy Wall Street, and those protests were localized near the exchange. So many protestors camped out near the bull sculpture that it remained fenced off for months after the protests ended. Many companies choose to visit the New York Stock Exchange to ring the ceremonial opening bell when they complete an IPO, and these events now bring some of the largest crowds to a largely automated exchange. After all, billions of daily trades couldn't be handled by a bunch of stock jockeys yelling numbers at screens. The automation of the New York Stock Exchange has, unfortunately, had the side effect of making dramatic market moves less human, as there's no longer a swarm of traders on the floor. Many of the market's wildest days occurred before the advent of computerized trading, when hundreds or thousands of traders and support staff made frantic efforts to profit (or at least minimize their losses): March 15, 1933: The Dow Jones Industrial Average (DJINDICES: ^DJI ) gains more than 15% after the resumption of trading following President Franklin D. Roosevelt's bank holiday. Oct. 19, 1987: Black Monday sends the Dow plummeting nearly 23%. Program trading (a precursor to high-frequency trading) is blamed, marking an unofficial shift toward remote electronic trading. Oct. 28 and Oct. 29, 1929: The unofficial beginning of the Great Depression was this sharp two-day break that began the Crash of 1929. Traders were remarkably optimistic at the close of both days, despite the Dow's 23% loss. However, that's not to say that wild swings went away when the traders left the floor. Some of the Dow's wildest days occurred during the period near the dot-com bubble peak and during the financial crisis of 2008. These events simply occurred without the familiar trope of traders yelling "buy, buy!" or "sell, sell!" at 18 Broad Street as a backdrop. A fiber upon the deep

General Telephone and Electronics (GTE, now a part of Verizon (NYSE: VZ ) ) completed the first commercial transmission through fiber-optic cables on April 22, 1977, when it routed some Long Beach, Calif., telephone traffic through a 6-megabit-per-second line. After decades of employing copper-based lines, telecommunications had finally stepped into the digital age. Whether you're viewing this article on a phone, a tablet, a laptop, or a PC, the data almost certainly reached you after zipping along fiber-optic cabling for most of its journey. Fiber optics became a hugely appealing subset of technological manufacturing during the dot-com boom, as it was predicted that the explosive growth of the Internet would require an enormous cable build-out to keep pace with data demands. Aided by rapid technological improvements, fiber-optic cable capacity exploded throughout the '90s, and system capacity doubled every six months from 1992 to 2001 -- a rate far outstripping the growth of computing power predicted by Moore's Law. Glassmaker Corning (NYSE: GLW ) soared nearly 500% from the start of 1998 to the peak of the dot-com bubble in early 2000 on hopes for its fiber-optic cable division. Corning had grown into the world's largest fiber-optics manufacturer, ahead of second-place Lucent and third-place Alcatel, which merged in 2006 to become Alcatel-Lucent (NYSE: ALU ) ; the combined stock chart for these companies shows a double from 1998 to early 2000. Millions of miles of fiber-optic cabling now crisscross the globe, but that hasn't helped either Corning or Alcatel-Lucent. The two largest fiber-optic manufacturers have suffered respective share-price declines of 70% and more than 90% since their peaks. Sometimes technological progress can be so fast that even its largest proponents lose out -- at least for a while. Given the explosive global growth of smartphones, many investors thought they would ride Corning's dominant cover glass to massive investment returns. That hasn't played out yet, as mobile growth has failed to offset declines in the company's core business. In this brand-new premium research report on Corning, our analyst walks through the business, as well as the key opportunities and risks facing it today. Click here to claim your copy.

After huge gains yesterday, the Dow Jones Industrial Average (DJINDICES: ^DJI ) is on the move once again. The index is up 67 points as of 11:35 a.m. EDT following positive jobs numbers after last week's disappointing reports. And though the tech sector had been some of the driving force behind the Dow's climb over the past two days, some bad news has caused many of the Dow's big players to fall. Last week was a rough one for the labor market, which had to bear the brunt of three negative jobs reports. With today's jobless claims release, investors are getting a breather from the bad news. Claims from last week fell sharply to 346,000 -- a 42,000 drop. This follows last week's huge jump to 388,000 claims, which was way over analyst expectations. This week's numbers fell below expectations, giving the markets some added fuel this morning. Because of the Easter holiday and spring break, jobs data can greatly vary in March and April, which is likely to be the reason we're seeing such great differences from week to week. But overall, the jobs data is signaling a decrease in layoffs, as businesses hold on to their workforces. Death of the PC -- it's real

Last night, the most recent sales data for PCs was released, much to the detriment of many tech stocks' gains for the week. Worldwide shipments of personal computers fell by 14% in the last quarter, the largest drop ever recorded by the IDC since it began tracking the data in 1994. The drop was double the amount expected by the IDC, and resulted in the fourth consecutive quarter with a year-over-year drop in sales. As you may have guessed, this is terrible news not only for the computer manufacturers, but also for software companies, processor manufacturers, and others. Hewlett-Packard (NYSE: HPQ ) is down 6.23% so far in trading, with news that its shipments were down by 24% year over year. Chief rival Dell's sales were also down, but by a much lower 11%. On the bright side, even though its shipments have dropped, HP still maintains a 25% share of the PC market -- the No. 1 spot. Microsoft (NASDAQ: MSFT ) is down 4.9% following the news. The company was dealt a double blow when Goldman Sachs downgraded it this morning, stating that its continued losses in market share and weak performance in entering the consumer electronics market is troubling. Mr. Softy is also partially being blamed for the slowdown in PC sales, due to Windows 8. The drastic change in user interface has been questioned, with some consumers feeling confused with the new OS, according to IDC's Bob O'Donnell. Intel (NASDAQ: INTC ) and its rival Advanced Micro Devices (NYSE: AMD ) are both feeling the losses, down 2.65% and 3.07%, respectively. Since both are heavily reliant on the PC market, any slowdown would be a big hit to revenue. Though Intel's latest efforts have made it a contender in the Chinese mobile market, it has a long way to go to gain real market share. AMD has also been working outside the PC, with several new game consoles expected to feature its new Jaguar processor that combines the console's CPU and graphics capabilities onto one chip. It's been a frustrating path for Microsoft investors, who've watched the company fail to capitalize on the incredible growth in mobile over the past decade. However, with the release of its own tablet, along with the widely anticipated Windows 8 operating system, the company is looking to make a splash in this booming market. In this premium report on Microsoft, our analyst explains that while the opportunity is huge, the challenges are many. He's also providing regular updates as key events occur, so make sure to claim a copy of this report now by clicking here.

Hacker makes encrypted message app NEW YORK (CNNMoney) In the post-Snowden world, encryption is cool. Lots of personal messaging apps want to cash in on privacy. Wickr is one of them. It's a free app that offers self-destructing, encrypted messages. But its founder, Nico Sell, sees vast and untapped potential in the finance industry. To her, Wickr is more than a cross between WhatsApp and Snapchat. "Our goal as Wickr is to run all the financial transactions in the world," she said. That's a lofty aspiration, especially for a company that's not profitable. But Sell wants you to think of Wickr as more than a social platform. She imagines it running in the background at big banks and stock markets. Related story: 5 online privacy tips from an ex-FBI agent Consider the startup's latest round of funding. It raised $30 million from a band of investors that included CME Group (CME), which runs the Chicago and New York mercantile exchanges. CME Group wouldn't say exactly how they plan to incorporate Wickr's technology into the commodity future trading that goes on at its exchanges. But there are at least two obvious uses: securing the communication that initiates millions of dollars of trades a day -- and keeping chats between stock brokers and traders secret. The draw? How Wickr claims to work. Text, photo, video and audio is encrypted into indecipherable code before it leaves your device. So, it's safely guarded as it travels via airwaves and wires to Wickr's computer servers and eventually to another person's device. Meanwhile, you can destroy messages you send by setting a timer. Theoretically, this system protects you from hackers and government snooping. Anyone listening in can't figure out what's being ! sent. How safe are you? Read CNNMoney's cybersecurity Flipboard Wickr hasn't let the public dig through its code openly and look for holes. But outside experts at digital forensics company Stroz Friedberg have said Wickr is keeping to its promise of using top-of-the-line encryption and leaving behind no metadata. And there's another aspect the finance industry might love. Imagine emails, trades and other sensitive files with an expiration date. Currently, the Securities and Exchange Commission requires accounting firms to keep their audit records for seven years. In criminal cases, regulators can look back and find evidence of misconduct. Finance companies would be smart to destroy those records at the appropriate time. In reality, they don't. "No one does, because they have no idea when that message was created," Sell said. "You have all this stuff waiting around for 10 or 15 years, and it becomes hazardous waste." Related story: Why you'll keep getting hacked As for worries that traders will use this future Wickr-inspired platform to engage in criminal behavior, Sell said she's currently devising a system that would allow the SEC limited access to traders' conversations -- but not all at once. Sell promised any solution wouldn't allow for NSA-style dragnets. Then again, she acknowledged that traders can already keep secrets from the government by using the current Wickr messaging app.

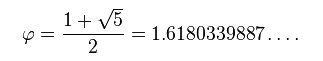

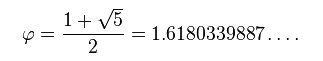

Every once in a while I like to circle back to some of the great questions I get from you. Today, I want to dive into one from Suzanne P., who wants to know if "Fibos" can help her make money in the markets. In a word, yes. But, you've got to understand what "Fibo" analysis is and how it works to make it profitable.... The Mathematical Sequence That Shows Up Everywhere "Fibo" is short for Fibonacci - as in, Leonardo Fibonacci. Born in Pisa, Italy, around 1170, he's considered by many to be the single most influential western mathematician of the Middle Ages. His 1202 book, Liber Abaci ("Book of Calculation"), remains instrumental to our understanding of mathematics to this day and is filled with examples that applied to money-changing, interest calculation, and commercial bookkeeping, for example. Today we know Leonardo simply as "Fibonacci," which is same name given to a numerical series in his book that he did not discover but that he used as an example. Despite their reputation as being difficult or complex, in reality, Fibonacci numbers are easy to learn and easy to understand. The sequence, if you're counting, looks like this... 1 1 2 3 5 8 13 21 34 55 and so on. Right away you can see a pattern. One plus one equals two. One plus two equals three. Two plus three equals five. And so on. But if you look closer, something else emerges. Every number in the series is approximately 0.618-to-1 in terms of its relationship to the number after it. This ratio never changes because the proportion remains the same. This is important so don't lose that thought; we're going to come back to it in a minute. What's simply amazing to me is that Fibonacci (and lots of scientists after him) have found Fibonacci numbers in nature. For example, the number of petals on flowers is often a Fibonacci number, as are the number of "cells" in a pineapple's skin. Pinecones, sunflowers, beehives... they all display Fibonacci's numbers or sequence in some way. More amazingly, plant leaves are often arranged in spirals or shapes that, when counted, are found to be adjacent Fibonacci numbers. In fact, if you divide the arc they form along a vine, for example, the arc length angle ratio is equal to 137.5 degrees. The numbers are so consistent that the relationship is actually called the "Golden Ratio" or the "Golden Mean." Mathematically, it looks like this, where the Greek letter phi represents the golden ratio:

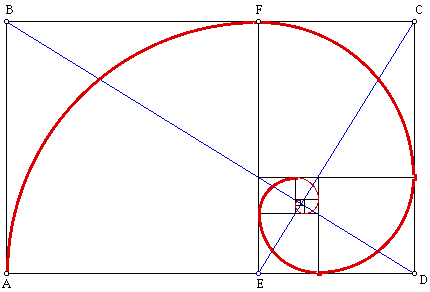

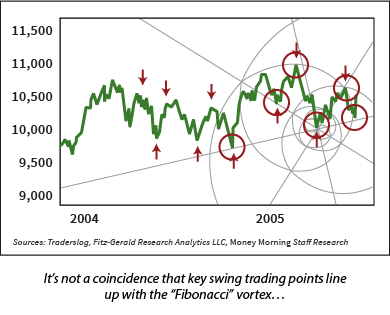

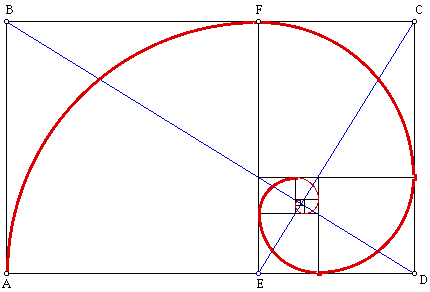

Geometrically, if you draw it out, the Fibonacci ratio or "Golden Mean," if you prefer, looks like this...

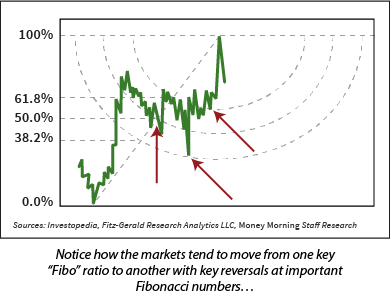

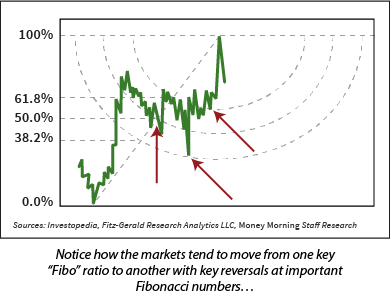

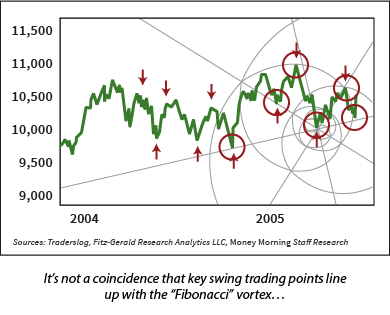

These relationships can be found all over the place in the natural world in everything from dolphins' fin sections to the ratio between human forearms and hands. Even the cochlea in our inner ear is a "golden" spiral adhering to this set of proportions. Fibonacci numbers and ratios can also be found - you guessed it - in the stock market. Fibo and Equities Admittedly, a lot of people have problems coming to terms with this. The data is a dubious fit, they say. Or, the computerization makes a natural order impossible, they challenge.  I disagree. The stock market represents the combined inputs and decision making of millions of participants at once. That means it is more like a living, breathing system than a static one. So while computers may temporarily change things, the natural order of human decision making is still very much a part of how markets work. Which means you can use the Golden Mean and the Fibonacci sequence to analyze them if you know what you are doing. For example, you can apply Fibonacci numbers to include range and retracement like this using a common tool known as the Fibonacci Arc, seen here on the right. Notice how price tends to move from one key "Fibonacci" level to another, especially when it comes to spotting likely reversals or breakdowns.  The Fibonacci sequence can also be applied to time, as at left. I particularly like this type of Fibonacci analysis because knowing how time passes can help me understand whether trends are likely to continue or falter. The Fibonacci sequence can also be applied to time, as at left. I particularly like this type of Fibonacci analysis because knowing how time passes can help me understand whether trends are likely to continue or falter.

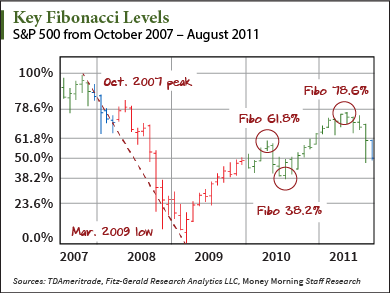

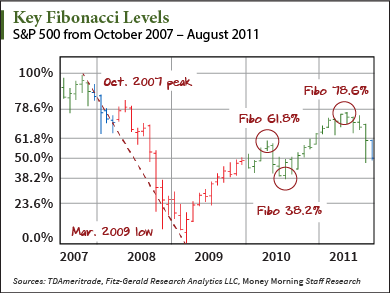

By the way, most online trading packages and analytics now include drawing tools based on the Fibonacci series. So even if you are mathematically challenged like I am, you can still harness the power inherent in the numbers. Start by "anchoring" on a recent major swing high or low if you're a day trader. If you're an investor with a multi-year perspective, I think a major market turning point is more appropriate. Then, extend the Fibonacci ratio or tool to subsequent turning points. What you are looking for is the "fit" between properly scaled charts and the Fibonacci tool you are using - be it arcs, lines, or ratios, for example. You'll know you have it when prices line up along key lines and intervals. Then you can look to what traders call the "hard right edge" or the last data point you have available and predict likely future turning points and market trends, as well as potential breakouts and key reversal levels, even though they haven't happened yet - often with remarkable accuracy. This, in turn, gives you an edge because you can be "on guard" for market movements that will take others by surprise. Let me show you... The Predictive Power of Fibonacci  The 57 % decline from October 2007 highs to March 2009 lows established an analytical anchor for the rally that built all the way to April 2010 when the markets had their first hiccup. Not coincidentally, the S&P 500 Index tacked on 83% over 13 months covering - drum roll, please - approximately 61.8% of the distances from the 2007 peak to the March 2009 low. What's more, Fibonacci analysis suggested that the pullback would peter out around 1010 despite the fact that millions of investors thought we were one leg away from another financial apocolypse. In fact, it held at 1,008, which is almost smack on the 38.2% Fibonacci retracement level suggested by the Fibonacci series and, in turn, the converse of the Golden Ratio. Subsequently, the index reversed and marched higher through May 2011, peaking just shy of the 78.6% before falling again to its next logical retracement level of 50% before taking off in earnest to where we are today. Obviously there is an element of subjective interpretation here, but you cannot deny the fact that Fibonacci analysis helped investors identify each of these important market turning points months in advance. This stuff is so good that I like to joke that if you put 5 Fibonacci practioniers in a room you will get 10 opinions about where the markets are headed. All joking aside, though, no two investors have the same time frame or risk tolerances. So the fact that there is a difference in opinion is vindication that Fibonacci numbers can help you spot opportunities others don't see. My good friend, Tom Gentile, agrees. Tom, who co-founded Optionetics, is one of the world's leading Fibonacci practioners. He believes "that there's definitely something there," which is why he uses both the Fibonacci ratio and the Golden Mean to pick entry prices and profit targets as part of his trading routine and as a complement to other analysis. Knowing what I've just explained, you now have the power to do the same thing. At the end of the day, there is no "Holy Grail," but the fact that an 800-year-old indicator works just as well today as it did centuries ago means there could be. From the Editor: Do you have a question for Keith to address in a future "Marketology" column? E-mail him at customerservice@moneymorning.com and ask away. He'd love to hear from you.

BALTIMORE (Stockpickr) -- Put down the 10-K filings and the stock screeners. It's time to take a break from the traditional methods of generating investment ideas. Instead, let the crowd do it for you.

>>3 Big-Volume Stocks in Breakout Territory From hedge funds to individual investors, scores of market participants are turning to social media to figure out which stocks are worth watching. It's a concept that's known as "crowdsourcing," and it uses the masses to identify emerging trends in the market.

Crowdsourcing has long been a popular tool for the advertising industry, but it also makes a lot of sense as an investment tool. After all, the market is completely driven by the supply and demand, so it can be valuable to see what names are trending among the crowd.

While some fund managers are already trying to leverage social media resources like Twitter to find algorithmic trading opportunities, for most investors, crowdsourcing works best as a starting point for investors who want a starting point in their analysis. Today, we'll leverage the power of the crowd to take a look at some of the most active stocks on the market today.

>>5 Stocks to Sell Before It's Too Late These "most active" names are the most heavily-traded names on the market -- and often, uber-active names have some sort of a technical or fundamental catalyst driving investors' attention on shares. And when there's a big catalyst, there's often a trading opportunity.

Without further ado, here's a look at today's stocks.

Under Armour Nearest Resistance: $54

Nearest Support: $50

Catalyst: Stock Split

Shares of sports apparel maker Under Armour (UA) are seeing big volume this afternoon, following a 2-for-1 stock split that went effective today. Under Armour has been a big momentum name over the last year, rallying more than 81% since April 2013, so it's not that surprising that UA was one of the names that's been correcting hard in 2014. But that doesn't mean that UA is in free-fall right now; in fact, shares are holding sideways in consolidation-mode.

The key levels to watch in UA right now are resistance at $54 and support at $50. Those are the price levels that buyers and sellers are battling it out between right now. A breakout above $54 makes UA a high-probability buy.

The Coca-Cola

Nearest Resistance: $41

Nearest Support: $39

Catalyst: Earnings

Beverage giant Coca-Cola (KO) is rallying more than 4% this afternoon, buoyed by strong earnings and a broad market that's fading hard in favor of blue chips as Tuesday's session drags on. Coke earned 36 cents per share for the first quarter, a number that got hit by currency conversion charges. Excluding currency charges, the firm met analyst expectations with non-GAAP earnings of 44 cents.

From a technical standpoint, today's 4% pop is solid, but it's far from meaningful. Shares broke out today, but they're still very close to a more important resistance level at $41. Be wary of buying KO until shares can catch a bid above that $41 price. There's more downside risk than upside potential at current levels.

J.C. Penney

Nearest Resistance: $8

Nearest Support: $6

Catalyst: Technical Setup

Meanwhile, shares of department store retailer J.C. Penney (JCP) are selling off this afternoon, shoved lower thanks to a textbook technical setup that's been setting up since the start of March. JCP has been forming a double-top pattern for the last month and a half, triggering a sell signal with Friday's breakdown through the $8 level.

The complete inability of J.C. Penney to catch a bid here is a big problem for longs right now. While support at $6 is far below, I wouldn't put too much faith in buyers down there. $5 is the next important support level if $6 fails.

Vale Nearest Resistance: $14.75

Nearest Support: $12

Catalyst: Dividend, Brazil ADR Selloff

Shares of Vale (VALE) are getting hammered 5.8% lower as I write this afternoon, pushed down by a combination of a big dividend distribution and a broad selloff in commodity-driven Brazilian ADRs today. A quick glance at this chart should be all it takes to see that the primary trend is down in Vale. In fact, shares have been tracking down in a textbook channel since last fall. This latest bounce off of trend line resistance in April is a good opportunity to sell again.

I'd avoid the long-side of this stock until it can break out of its downtrend. To see these stocks in action, check out the at Most-Active Stocks portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

RELATED LINKS:

>>5 REIT Trades Worth Buying in April

>>5 Rocket Stocks for a Tumbling Market

>>5 Stocks Poised for Breakouts

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Jonas Elmerraji, CMT, is a senior market analyst at Agora Financial in Baltimore and a contributor to TheStreet. Before that, he managed a portfolio of stocks for an investment advisory returned 15% in 2008. He has been featured in Forbes , Investor's Business Daily, and on CNBC.com. Jonas holds a degree in financial economics from UMBC and the Chartered Market Technician designation. Follow Jonas on Twitter @JonasElmerraji

With today's 15% pop just staring you in the face, it would be tempting for current MeetMe Inc. (NYSEMKT:MEET) shareholders to lock their profit in and walk away. It would also be a mistake, though. See, while MEET is admittedly a volatile mess in the short run, for the long haul, there's a lot more upside left to tap. If the idea and the ticker seem familiar, it may be because yours truly penned some bullish thoughts on MEET back on February 7th.... and October 29th, and October 23rd, and October 18th, and July 18th, and July 8th.... you get the idea. And, while it's been an exhausting journey with lots and twists and turns, MeetMe Inc. shares are now up 60% since my love affair with the stock began back in the middle of last year. I don't come here to gloat, however. I'm revisiting MeetMe again today to reiterate a point I've made about it several times since starting to log the saga - there's a ton of upside potential here, that could last for months, and end up creating strong triple-digit gains. You just have to take a step back and look at a long-term, weekly chart of MEET to see it. So, that's what we'll do. There are two things to note about this longer-term chart: (1) Although it's been up-and-down for years, as of the past few months, there's more 'up' than 'down' for MEET now [see the rising MACD lines, both now above the zero level], and, (2) there's plenty of volume behind the current bullishness from MeetMe, telling us it's got the participation it needs to last [one of the missing ingredients of the prior breakout attempts].

Between those two nuances and the fact that this stock was trading at $10.00 just a few years ago, there's a ton of room to recover here... and MeetMe Inc. is acting like it wants to use all of that potential. With all of that being said, as bullish as MEET may be in the long run, today isn't the time to step into a new trade. Between this morning's opening gap and the stock's usual ebb and flow, odds are good that MeetMe shares could pull back to the $2.50-ish level again sooner than later. That's the spot where you'd want to wade into this impressive but admittedly volatile long-term uptrend. For more trading ideas and insights like these, be sure to sign up for the free SmallCap Network newsletter. You'll get stock picks, market calls, and more, every day. Here's what you've missed recently.

SAN FRANCISCO — Twitter CEO Dick Costolo on Wednesday came out pitching the case for the service's mainstream potential as the company faced growth concerns in its first financial report to Wall Street since going public. Twitter beat Wall Street's sales and profit forecasts, but shares nose-dived more than 17% in after-hours trading on lackluster user growth and engagement figures. "We can increase high-quality interactions and make it more likely that new or casual users will find the service as indispensable as our existing core users do," Costolo said on the company's conference call. Share of Twitter plummeted $11.59, to $54.38, following its letdown that monthly active users came in at 241 million, a 30% year-over-year increase but well below expectations. Twitter's engagement dropped to 148 billion Timeline Views, an 11 billion decline from the previous quarter. SHINAL: Wall Street has yet to learn Twitter's language "What twitter needs to prove is two things, that they can dramatically increase engagement with advertisers and they can dramatically increase engagement with users. The market is now questioning whether they can go mainstream," said RBC Capital Markets analyst Mark Mahaney. The company, based here, reported $9.8 million in net income, or 2 cents per share, on $243 million in revenue. Twitter was expected to report a loss of $13 million in net income on $218 million in revenue in the quarter, according to the survey of estimates from Thomson Reuters. Analysts were predicting a loss of 2 cents per share. Twitter said in its earnings report that it now sees 75% of its advertising revenue from mobile, up from 70% in the previous quarter. Shares of Twitter have seen a 47% run-up in trading since the company went public Nov. 7. "We feel very well positioned for growth in 2014," said Costolo. Twitter has a lofty valuation relative to its peers. Twitter is valued at about $37 billion, or nearly 33 times estimated 2014 sales! of $1.2 billion. Meanwhile, Facebook trades at 14 times this year's sales forecasts while LinkedIn is at 12 times. Also of concern, Twitter's deceleration of monthly active users, a closely watched measurement, raises questions about its ability to continue to grow as steadily as Facebook. The company faces some headwinds in lock-up expirations on its stock as well. About 9.9 million shares will become eligible for sale by non-executive insiders on Feb. 15, and on May 7 it's expected that 454.3 million shares held by all insiders will lose trading restrictions, putting downward pressure on the stock. "My guess is that Twitter will be successful long term in re-accelerating user engagement," said Mahaney.

Steven Senne/AP ATLANTA -- Target said Friday that debit-card PINs were among the financial information stolen from millions of customers who shopped at the retailer earlier this month. Target (TGT) said the stolen personal identification numbers, which customers type in to keypads to make secure transactions, were encrypted and that this strongly reduces risk to customers. In addition to the encrypted PINs, customer names, credit and debit card numbers, card expiration dates and the embedded code on the magnetic strip on back of the cards were stolen from about 40 million credit and debit cards used at Target stores between Nov. 27 and Dec. 15. Security experts say it's the second-largest theft of card accounts in U.S. history, surpassed only by a scam that began in 2005 involving retailer TJX Cos. (TJX). Target said it doesn't have access to nor does it store the encryption key within its system, and the PIN information can only be decrypted when it is received by the retailer's external, independent payment processor. "We remain confident that PIN numbers are safe and secure," spokeswoman Molly Snyder said in an emailed statement Friday. "The PIN information was fully encrypted at the keypad, remained encrypted within our system, and remained encrypted when it was removed from our systems." The company maintains that the "key" necessary to decrypt that data never existed within Target's system and couldn't have been taken during the hack. However, Gartner security analyst Avivah Litan said Friday that the PINs for the affected cards aren't safe and people "should change them at this point." Litan said that while she has no information about the encrypted PIN information in Target's case, such data has been decrypted before, in particular the 2005 TJX Cos. hacking case that's believed the largest case of identity theft in U.S. history. In 2009 computer hacker Albert Gonzalez plead guilty to conspiracy, wire fraud and other charges after masterminding debit and credit card breaches in 2005 that targeted companies such as T.J. Maxx, Barnes & Noble (BKS) and OfficeMax. Gonzalez's group was able to decrypt encrypted data. Litan said changes have been made since then to make decrypting more difficult but "nothing is infallible." "It's not impossible, not unprecedented [and] has been done before," she said. Besides changing your PIN, Litan says shoppers should opt to use their signature to approve transactions instead because it is safer. Still, she said Target did "as much as could be reasonably expected" in this case. "It's a leaky system to begin with," she said. Credit card companies in the U.S. plan to replace magnetic strips with digital chips by the fall of 2015, a system already common in Europe and other countries that makes data theft more difficult. Minneapolis-based Target Corp. said it is still in the early stages of investigating the breach. It has been working with the Secret Service and the Department of Justice. -. Steven Senne/AP ATLANTA -- Target said Friday that debit-card PINs were among the financial information stolen from millions of customers who shopped at the retailer earlier this month. Target (TGT) said the stolen personal identification numbers, which customers type in to keypads to make secure transactions, were encrypted and that this strongly reduces risk to customers. In addition to the encrypted PINs, customer names, credit and debit card numbers, card expiration dates and the embedded code on the magnetic strip on back of the cards were stolen from about 40 million credit and debit cards used at Target stores between Nov. 27 and Dec. 15. Security experts say it's the second-largest theft of card accounts in U.S. history, surpassed only by a scam that began in 2005 involving retailer TJX Cos. (TJX). Target said it doesn't have access to nor does it store the encryption key within its system, and the PIN information can only be decrypted when it is received by the retailer's external, independent payment processor. "We remain confident that PIN numbers are safe and secure," spokeswoman Molly Snyder said in an emailed statement Friday. "The PIN information was fully encrypted at the keypad, remained encrypted within our system, and remained encrypted when it was removed from our systems." The company maintains that the "key" necessary to decrypt that data never existed within Target's system and couldn't have been taken during the hack. However, Gartner security analyst Avivah Litan said Friday that the PINs for the affected cards aren't safe and people "should change them at this point." Litan said that while she has no information about the encrypted PIN information in Target's case, such data has been decrypted before, in particular the 2005 TJX Cos. hacking case that's believed the largest case of identity theft in U.S. history. In 2009 computer hacker Albert Gonzalez plead guilty to conspiracy, wire fraud and other charges after masterminding debit and credit card breaches in 2005 that targeted companies such as T.J. Maxx, Barnes & Noble (BKS) and OfficeMax. Gonzalez's group was able to decrypt encrypted data. Litan said changes have been made since then to make decrypting more difficult but "nothing is infallible." "It's not impossible, not unprecedented [and] has been done before," she said. Besides changing your PIN, Litan says shoppers should opt to use their signature to approve transactions instead because it is safer. Still, she said Target did "as much as could be reasonably expected" in this case. "It's a leaky system to begin with," she said. Credit card companies in the U.S. plan to replace magnetic strips with digital chips by the fall of 2015, a system already common in Europe and other countries that makes data theft more difficult. Minneapolis-based Target Corp. said it is still in the early stages of investigating the breach. It has been working with the Secret Service and the Department of Justice. -.

Ron Burgundy, of Dodge Durango TV and online ad fame, finished the weekend in second place in the box office listings. But that's not bad considering the competition, and that the Will Ferrell comedy, Anchorman 2: The Legend Continues, may be considered one of the top driving movies of the year. Yes, driving. The absurdist comedy features bowling balls, scorpions and really bad driving, especially when it comes to a vintage motor home that rolls over. But getting what looks to be an old General Motors RV to actually perform the needed rollover was a monumental task. While Will Ferrell, Steve Carell, Paul Rudd and David Koechner had a great time yukking it up, pretending to roll in the crash against a green screen background. Writer-director McKay has called it "a giant pain in the ass" to get the scene for the scene he and Ferrell wrote at two in the morning. It ended up taking three days to shoot. But McKay had his hands full with the real exterior shots of the dramatic rollover crash. He hired one of the best Hollywood stuntmen going and three old RVs to make sure he got the shot. But the trailer just wouldn't perform the shot. "It's insane, there's no way we could get it to roll," says McKay. "It's just such an oddly shaped vehicle."

"We really had to find the right angle to do it," he adds. "We did three tries, and we finally got the roll and the shot we needed on the last one. Thank God."

Although we don't believe in timing the market or panicking over market movements, we do like to keep an eye on big changes -- just in case they're material to our investing thesis. What: Shares of Rovi (NASDAQ: ROVI ) have lost nearly 12% today as a result of the company's disappointing earnings report. Both top and bottom lines missed estimates, and the company is now contemplating divestitures to keep itself afloat. So what: Rovi's third-quarter earnings report showed a 13% year-over-year decline in revenue to $143 million, which was weaker than the $152 million Wall Street had modeled. Rovi's GAAP net loss was $0.12 per share, which is slightly better than the $0.13 GAAP EPS loss from the year-ago quarter, but adjusted earnings of $0.41 per share were a big swing-and-a-miss at the $0.48 analyst target. Going forward, Rovi now expects annual revenue of $585 million to $615 million, which barely reaches the $613.5 million consensus on the high end. It's the second consecutive guidance downgrade for this fiscal year. Rovi's full-year EPS guidance of $1.70 to $2.00 is slightly better, as Wall Street is looking for $1.94 per share, but it is also a downgrade from earlier guidance. As a result of this weakness, Rovi is now actively investigating the sale of its DivX video codec business. Now what: Two consecutive guidance downgrades and a divestiture on the horizon? This doesn't exactly paint a picture of health for Rovi. If you're interested in possible deep-value turnaround stories, you may want to dig deeper, but this company's momentum appears to be moving in the wrong direction. I'd stay on the sidelines until more clarity emerges on the DivX sale, at least. Want more news and updates? Add Rovi to your watchlist now. Invest in real growth

Tired of watching your stocks creep up year after year at a glacial pace? Motley Fool co-founder David Gardner, founder of the No. 1 growth stock newsletter in the world, has developed a unique strategy for uncovering truly wealth-changing stock picks. And he wants to share it, along with a few of his favorite growth stock superstars, WITH YOU! It's a special 100% FREE report called "6 Picks for Ultimate Growth." So stop settling for index-hugging gains... and click HERE for instant access to a whole new game plan of stock picks to help power your portfolio.

InvestmentNews today announced the winners of the first annual Best Practices awards, acknowledging 24 advisory firms in two categories, human capital management and technology. Award winners were honored at a best practices workshop in Chicago. The awards were given based on results from the InvestmentNews Compensation and Staffing Study, as well as personal interviews. The winners are as follows: Human Capital Management, Industry Innovators: Balasa Dinverno Foltz LLC, Itasca, Ill., bdfllc.com Briaud Financial Advisors, College Station, Texas, briaud.com Fish & Associates, Memphis, Tenn., fishandassociates.com JMG Financial Group Ltd., Oak Brook, Ill., jmgfinancial.com JVL Associates LLC, Wyoming, Mich., jvlassociates.com Singer Xenos Wealth Management, Coral Gables, Fla., singerxenos.com Human Capital Management, Top-Performing firms: Johnson Carriar Kruchten Anderson & Associates, Saint Cloud, Minn., ameripriseadvisors.com Pinnacle Advisory Group Inc., Columbia, Md., pinnacleadvisory.com Rinvelt & David LLC, Grand Rapids, Mich., rinveltdavid.com Roof Advisory Group Inc., Harrisburg, Pa., roofadvisory.com Vintage Financial Services LLC, Ann Arbor, Mich., vintagefs.com Willow Street Advisors LLC, Naples, Fla., willowstreetadvisors.com Overall Use of Technology, Industry Innovators: Empirical Wealth Management, Seattle, empirical.net Financial Plan Inc., Bellingham, Wash., financialplaninc.com Joseph Barry Co. LLC, New Bedford, Mass., josephbarry.com Searcy Financial Services Inc., Overland Park, Kan., searcyfinancial.com Strategic Capital Allocation Group LLC, Boston, scagrp.com The Arkansas Financial Group Inc., Little Rock, Ark., arfinancial.com Overall Use of Technology, Top-Performing Firms: Bedrock Capital Management Inc., Los Altos, Calif., bedrockcapital.com Budros Ruhlin & Roe Inc., Columbus, Ohio, b-r-r.com Evensky & Katz LLC, Coral Gables, Fla., evensky.com Roof Advisory Group Inc., Harrisburg, Pa., roofadvisory.com Shelton Financial Group Inc., Fort Wayne, Ind., sheltonfinancial.com Yellow Brick Road Financial Advisors LLC, San Francisco, ybrfinancialadvisors.com

NEW YORK (TheStreet) -- Pandora Media (P) shares dropped 3.9% to $23.06 after the music-streaming company filed a secondary share offering. In the proposed filing, Oakland-based Pandora said it will sell 10 million additional shares, and another 4 million shares from current stockholders. To appease the bankers on the deal, Pandora said in a filing that it "intends to grant the underwriters a 30-day option to purchase up to an additional 2,100,000 shares to cover over-allotments, if any." Pandora said it expects to use the proceeds "for general corporate purposes, including working capital and capital expenditures." Also included in the offering, Pandora said it may use the proceeds for acquisitions. The lead bookrunners on the offering will be J.P. Morgan and Morgan Stanley. Wells Fargo Securities, BofA Merrill Lynch, BMO Capital Markets, Canaccord Genuity, Needham & Company, Pacific Crest Securities, Piper Jaffray and William Blair are acting as co-managers. --Written by Chris Ciaccia in New York >Contact by Email. Follow @Chris_Ciaccia

DELAFIELD, Wis. (Stockpickr) -- At Stockpickr, we track daily portfolios of stocks that are the biggest percentage gainers and the biggest percentage losers.

>>5 Big Trades You Can't Miss This Week

Stocks that are making large moves like these are favorites among short-term traders because they can jump into these names and try to capture some of that massive volatility. Stocks that are making big-percentage moves either up or down are usually in play because their sector is becoming attractive or they have a major fundamental catalyst such as a recent earnings release. Sometimes stocks making big moves have been hit with an analyst upgrade or an analyst downgrade.

Regardless of the reason behind it, when a stock makes a large-percentage move, it is often just the start of a new major trend -- a trend that can lead to huge profits. If you time your trade correctly, combining technical indicators with fundamental trends, discipline and sound money management, you will be well on your way to investment success.

>>5 Stocks Under $10 Hedge Funds Love

With that in mind, let's take a closer look at a several stocks under $10 that are making large moves to the upside today. Salem Communications

Salem Communications (SALM) is a domestic multimedia company with integrated business operations covering radio broadcasting, publishing and the Internet. This stock closed up 8.8% to $7.84 in Thursday's trading session.

Thursday's Range: $7.23-$7.87

52-Week Range: $4.62-$10.14

Thursday's Volume: 62,000

Three-Month Average Volume: 38,783

>>5 Stocks Warren Buffett Is Buying in 2013

From a technical perspective, SALM bounced sharply higher here right above some near-term support at $7.20 and back above its 50-day moving average at $7.73 with above-average volume. This stock has been trending sideways for the last three months and change, with shares moving between $7 on the downside and $8.22 on the upside. Shares of SALM are now quickly moving within range of triggering a major breakout trade above the upper-end of its recent sideways trading chart pattern. That breakout will hit if SALM manages to take out some near-term overhead resistance levels at $8 to $8.22 with high volume.

Traders should now look for long-biased trades in SALM as long as it's trending above some key near-term support levels at $7.20 or above its 200-day at $6.95 and then once it sustains a move or close above those breakout levels with volume that hits near or above 38,783 shares. If that breakout triggers soon, then SALM will set up to re-test or possibly take out its next major overhead resistance levels at $9.27 to $10. Key Energy Services

Key Energy Services (KEG) provides well services to oil companies, foreign national oil companies and independent oil and natural gas production companies. This stock closed up 5.7% to $6.84 in Thursday's trading session.

Thursday's Range: $6.48-$6.94

52-Week Range: $5.61-$9.57

Thursday's Volume: 1.42 million

Three-Month Average Volume: 2.39 million

>>Hedge Funds Hate These 7 Stocks -- but Should You?

From a technical perspective, KEG ripped higher here right above its 50-day moving average of $6.39 with lighter-than-average volume. This move is quickly pushing shares of KEG within range of triggering a major breakout trade. That trade will hit if KEG manages to take out some near-term overhead resistance levels at $6.89 to its 200-day moving average at $7 with high volume.

Traders should now look for long-biased trades in KEG as long as it's trending above its 50-day at $6.39 or above more support at $6.06 and then once it sustains a move or close above those breakout levels with volume that hits near or above 2.39 million shares. If that breakout triggers soon, then KEG will set up to re-test or possibly take out its next major overhead resistance levels at $7.35 to $7.89. Any high-volume move above those levels will then put its next major overhead resistance levels at $8.25 to $8.92 within range for shares of KEG.

Mecox Lane

Mecox Lane (MCOX) offers a selection of products apparel, accessories and home and health care products through its online platform and third party e-commerce Web sites. This stock closed up 9.5% to $3.66 in Thursday's trading session.

Thursday's Range: $3.23-$3.80

52-Week Range: $1.67-$7.88

Thursday's Volume: 179,000

Three-Month Average Volume: 207,259

>>5 Stocks With Big Insider Buying

From a technical perspective, MCOX bounced sharply higher here right above its 200-day moving average of $3.06 with decent upside volume. This stock recently pulled back sharply from its high of $7.88 to its recent low of $3.30. During that pullback, shares of MCOX have been consistently making lower highs and lower lows, which is bearish technical price action. That said, shares of MCOX might be ready to see its downside volatility cease, and the stock spike sharply higher.

Traders should now look for long-biased trades in MCOX as long as it's trending above its recent low at $3.30 or above its 50-day at $2.98 and then once it sustains a move or close above some near-term overhead resistance at $4 with volume that hits near or above 207,259 shares. If we get that move soon, then MCOX will set up to re-test or possibly take out its next major overhead resistance levels at $4.76 to its gap down day high at $5.15. Any high-volume move above those levels will then give MCOX a chance to re-fill some of its previous gap down zone from this month that started at $7.88.

Yingli Green Energy

Yingli Green Energy (YGE) engages in the design, development, marketing, manufacture, installation and sale of photovoltaic products. This stock closed up 1.9% to $4.19 in Thursday's trading session.

Thursday's Range: $3.93-$4.27

52-Week Range: $1.25-$4.83

Thursday's Volume: 6.62 million

Three-Month Average Volume: 4.45 million >>5 Stocks Rising on Unusual Volume

From a technical perspective, YGE spiked modestly higher here right above its 50-day moving average of $3.68 with heavy upside volume. This stock recently formed a double bottom chart pattern at $3.57 to $3.55. Following that bottom, shares of YGE have started to trend higher and move within range of triggering a major breakout trade. That trade will hit if YGE manages to take out some near-term overhead resistance levels at $4.40 to its 52-week high at $4.83 with high volume.

Traders should now look for long-biased trades in YGE as long as it's trending above some key near-term support at $3.55 and then once it sustains a move or close above those breakout levels with volume that hits near or above 4.45 million shares. If that breakout hits soon, then YGE will set up to enter new 52-week-high territory, which is bullish technical price action. Some possible upside targets off that breakout are its next major overhead resistance levels at $6.27 to $7.

Nautilus

Nautilus (NLS), a fitness products company, provides solutions to help people achieve a fit and healthy lifestyle. This stock closed up 4.7% to $6.79 in Thursday's trading session.

Thursday's Range: $6.49-$6.88

52-Week Range: $2.28-$9.87

Thursday's Volume: 338,000

Three-Month Average Volume: 487,173

>>5 Heavily Shorted Stocks That Hedge Funds Love

From a technical perspective, NLS jumped higher here right above its 200-day moving average of $6.37 with lighter-than-average volume. This stock recently dropped sharply from its high of $9.87 to its low of $6.15 with heavy downside volume. During that drop, shares of NLS have been consistently making lower highs and lower lows, which is bearish technical price action. That said, shares of NLS have held above its 200-day following the drop, and the stock now looks ready to cease its downside volatility. Shares of NLS are starting to move within range of triggering a near-term breakout trade. That trade will hit if NLS manages to clear some near-term overhead resistance at $6.99 with high volume.

Traders should now look for long-biased trades in NLS as long as it's trending above its 200-day at $6.37 or above more near-term support at $6.15 and then once it sustains a move or close above $6.99 with volume that hits near or above 487,173 shares. If that breakout hits soon, then NLS will set up to re-test or possibly take out its next major overhead resistance levels $8 to its 50-day at $8.25.

To see more stocks that are making notable moves higher today, check out the Stocks Under $10 Moving Higher portfolio on Stockpickr.

-- Written by Roberto Pedone in Delafield, Wis.

RELATED LINKS:

>>5 Stocks Under $10 Set to Soar

>>The Icahn Effect: Is Apple the Next Netflix?

>>5 New Trades From Renaissance Technologies

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.