Turnkey investing is a very hot topic in real estate circles and seems to only be getting hotter. On a daily basis in the BiggerPockets Forums there could be from half a dozen to two dozen conversations involving turnkey real estate. Those conversations may involve questions from new investors to advertisements of opportunities, but almost all of them get comments from investors who hate the concept. Some are uninformed opinions, and others are comments from experience, but all seem to point to two clear conclusions:

There is no definition of what turnkey real estate really means. The worst investment you can make is a cheap $40,000 turnkey property!

Read this article carefully, and pay close attention to the end. If you are thinking about buying turnkey investments, there are many great opportunities all around the country, but there are probably more out there that are not. Investors are often their own worst impediment to making turnkey portfolios work, and I give a few ideas at the end regarding which investors this concept works for best!

What is turnkey real estate?

To be very brief, turnkey real estate involves a model where an investor purchases a property -- usually for long-term buy and hold -- that another investor or company has purchased, renovated and put under in-house management with a tenant. That is my definition of a turnkey real estate investment. However, and unfortunately for investors everywhere, every week there are new turnkey companies popping up and creating their own spin on what it means to be "turnkey."

Some companies own all of the services, while some do not. Some offer a completed property with tenant, some do not. Some companies are fully capitalized, while others need to use an investor's money. Still other companies act as a real estate broker working off the MLS and then broker all of the after-purchase renovation and management services as well.

I am not here to tell you as an investor which one of these definitions is correct. I have been in this business for a number of years now and have seen all of the good (and most of the bad) and can honestly say that the word "turnkey" no longer has any true meaning. It is defined by the seller and marketed and sold to the buyer. As an investor, this is a major issue when you begin to investigate buying turnkey investments because different companies will have a different definition of the word "turnkey" to fit their model.

Related: What Are The Different Kinds of Turnkey Properties?

What I will tell you is that no matter the definition, there is one type of investment that I have seen fail every time when it comes to turnkey properties. In my opinion, the real blame for this failure falls on the constant marketing of turnkey investments and the lack of experience on the part of turnkey companies. Everyone markets the same thing and attaches the same emphasis on return and service without thought about how those two things are going to be delivered.

If you are looking to invest in real estate through a turnkey provider, exercise extreme caution when it comes to the marketing and pricing of properties. There are two absolutes when it comes to this business: turnkey investments sold at super cheap prices with super high returns are the riskiest investment you can make today. No matter how sincere a company or turnkey provider may be, it is impossible to maintain long-term relationships and high-level management and service without building in the revenue.

High quality renovations, high quality customer service and high quality long-term investments are not words that can be used by super cheap, low-end property turnkey sellers. They do not go hand in hand.

The worst turnkey investment

I started as an active real estate investor and had many opportunities to invest all over the country. My business was extremely successful, which gave me all the capital I needed to make lots of mistakes! I didn't know it at the time, but my biggest mistakes were the properties I was investing in for passive income. I was buying a lot of properties in Memphis, where I had spent part of my time growing up and where my family was still investing. The properties were turnkey for all intents and purposes even though that term wasn't really out there at the time. What attracted me most (looking back it is easy to see why I, like many new investors, was attracted) were the low prices and low barrier of entry into real estate. I was buying cheap properties with little work being done to them -- and what on paper were fantastic double-digit returns.

Before long, I had other investors around me asking what I was doing and what projects I was working on ... so I told them. These same investors were some of the first investors to push my family to start our turnkey company. Unfortunately, like I said, when we first started, we fell into the mind-set that super cheap properties with super high returns were great investments. We also believed that the best way to compete for investors was to offer cheap pricing. Keep the pricing low, and allow investors a low hurdle to their plans to build portfolios.

I speak from experience when I tell you that cheap properties -- defined by me as anything priced $50,000 and under -- make the worst turnkey investments. I have had them in my portfolio, and I have managed them in the past for other investors, and they are not profitable for anyone. We are currently managing over 2,700 turnkey investment properties, and here are our conclusions from reviewing factual data from managing those properties:

Two percent rent ratios are unicorns in the turnkey industry. They may pencil out as 2% properties, but you will pay in deferred maintenance what you should have paid for proper renovation and see your rent ratio cut to 1.5% or less. Turnkey providers who operate with these low price properties have two major issues to overcome and one, if not both, eventually force a change in model.

It is impossible to staff a turnkey company correctly with a focus on high-touch customer and tenant relations when selling low-cost properties. There is not enough room to build in the needed revenue to build and train a team properly. In the end the client and the tenant lose out, which both lead to problems for the company.

It is not realistic for an owner to plan to spend a vast majority of revenue on team and systems, in turn keeping their own income low. In my experience, many choose a different concept altogether called "stay small, keep it all." They choose to remain a small company while still marketing like a big company and simply keep the profit all to themselves. You can guess who loses out in this scenario!

Because renovations are often done at the lowest prices possible and some maintenance issues are deferred, those issues eventually have to be dealt with while a tenant is in place. At the same time, permits are a sticking point since permits can drive up pricing in some cases by 2% ($1,000 in permits for electric, water and gas on a $50,000 property). So often work is done without permits, which can lead to more issues in the future when deferred maintenance has to be addressed and no issues have ever been pulled for any work. At some point, the major work on a property is going to have to be permitted, and often that falls on the owner when they are dealing with deferred maintenance.

Tenants do not hang around properties with ongoing maintenance issues, and management companies do not survive when poorly renovated low-price properties eat up their time and resources. There simply is not enough money in the deal to operate on a high level and deliver on marketing promises to owners.

It is a vicious cycle, where the company does not make enough money to cover permits or to hire and train team members. At the same time, because of efforts to keep prices low, more work has to be done on an ongoing basis. Eventually a turnkey company owner realizes their time is worth more than they are earning, and they have to change their model.

Which investor should buy turnkey properties?

The answer is: any investor who values service and quality over hyped returns and wants a steady yield in return for a passive investment. Unfortunately, that does exclude a lot of investors who end up being sold turnkey investments anyway!

Related: The Lessons of 'Rent Ready' And Turnkey Investment Properties

Brand new investors who are struggling to come up with down payments on investment properties should avoid turnkey investing at all costs. These are the investors who are most likely going to get caught up in a cheap property offering. Remember that turnkey investments are categorized as passive for the most part. There are literally dozens of ways to get started investing in real estate in a passive manner without running the risk of buying cheap turnkey properties that cannot perform at a level you should expect.

What level of performance should you expect? Well, for starters, there should be no deferred maintenance. On an average 1,500 sq. ft. property, the renovation costs could easily reach $25,000 when all systems, roof, flooring, paint, locks, doors, hardware, lighting, permits, fence, aesthetics and trees planted near water and sewage lines are addressed.

On the management side, an investor should expect a property management company to be owned and operated by the turnkey company and to be 100% responsible for the performance of that property. The property management company should be staffed at a level where the tenants and investors both can get quick service and fast replies. In my opinion, customer service fits right under the property management column since most of the communication for an investor occurs after they purchase a property is going to involve property management.

Customer service, in my opinion, does not involve having an answering service take in coming calls so you can return them. Customer service means going above and beyond so an investor buying from 1,500 miles away feels they have competent, safe and secure investments. It means reaching out when there are issues and being proactive on move-outs, as well as maintenance and rental issues. Whether a company is any good at providing service is another story! They have to at least have the personnel and systems in place before they can do it!

Passive investing, especially in a turnkey investment, should be all about the highest level of service, consistent returns and a no-hassle experience as much as possible. None of those things occurred when I was buying the super cheap properties from far away. None of those things were important when we first stated buying and offering cheap properties. And none of those things are present today when investors turn to super-cheap turnkey investments. Turnkey should be held to a very high standard by investors if they want to have a good and profitable experience.

Are you a turnkey investor? What would you add to my assessment?

This article originally appeared on Bigger Pockets and is Copyright 2014 BiggerPockets,

The smart way to get more income in retirement

Getting a part-time job is one way to increase your income in retirement, but it isn't the smart way. In a brand-new free report, our retirement experts explain a straightforward strategy that people are already using to secure an even more comfortable retirement. The method is so simple you'll be shocked you didn't think of it yourself. To access this free report instantly, simply click here now.

Getty Images

Getty Images

Jeff Chiu/AP So far, 2014 has been a high-scoring year for initial public stock offerings. The first quarter saw more IPO activity than any other initial quarter since 2000, with 64 companies listing on various U.S. exchanges raising a collective $10.6 billion. That's more than double the number of IPOs that took place in the first quarter of 2013. This is directly related to the health of the overall stock market. Generally speaking, the better shares are performing, the higher the chance of an issuer being successful on IPO day. After all, who's eager to buy anything when the market's in the doldrums? Yet even in a good environment for IPOs, companies occasionally get the jitters and withdraw their listings. Sometimes this is due to the overall atmosphere on the market; sometimes it's because of difficulties with the issuing company itself; sometimes it's both. Whatever the reason(s), the notable examples below scampered away before they could become publicly traded entities. Square One of the top anticipated IPOs of 2014 was for this cutting-edge e-commerce company, which pioneered the use of smartphone and tablet payment card readers. Then there's Square's impeccable geek credentials, thanks in no small part to its founder-CEO Jack Dorsey, who was one of the guiding lights behind Twitter (TWTR). That, apparently, wasn't enough to bring it to market. In late February, media reports had it that the company postponed its planned IPO indefinitely. It seems that it's burning through cash very quickly and doesn't have enough revenue to cover this. Instead of listing on an exchange, the firm is reportedly looking for a deep-pocketed suitor and has allegedly held discussions with Google (GOOG), Apple (AAPL) and eBay (EBAY), and possibly even one of its investors, Visa (V), regarding a potential buyout. Square denies it has been in acquisition talks. Trustwave Holdings Another nonstarter in the tech IPO space was Trustwave, which provides on-demand data security solutions. After Target (TGT) suffered a large-scale breach of its credit card data last November, both the retailer and Trustwave were sued by a pair of regional banks that claimed they suffered financial damages from the incident. Trustwave claimed that it didn't outsource data security to Target (it's hard to tell -- such arrangements are usually confidential). Nevertheless, the lawsuit attracted the wrong kind of publicity before the banks dropped it in April. Interestingly, Trustwave's cancellation of the IPO was its second; the first was a flotation planned for August 2011. This time, the company was to sell 6.25 million shares priced at $15 to $17 apiece on the Nasdaq. The underwriting syndicate was led by heavyweights Morgan Stanley (MS), JPMorgan Chase's (JPM) J.P. Morgan unit and Barclays (BCS) Capital. Sundance Energy Australia The world just can't get enough energy; oil and gas markets are thriving these days. Combine that with a strong market for IPOs, and you've got a bunch of new issues in the energy sector listing on stock markets. Sundance Energy Australia had planned to complement the extant listing on its native exchange by floating nearly 7.8 million American depository shares on the Nasdaq. The issue was slated for this past February and was to be lead-underwritten by Wells Fargo (WFC) Securities, Canaccord Genuity and UBS (UBS) Investment Bank. But in April the company pulled the issue due to market conditions. That's a shame, as Sundance likely would have attracted investor interest given that it has a presence in rich U.S. plays such as the Bakken formation in the Midwest. Although the company's net result hasn't always been positive, Sundance almost doubled its top line on a year-over-year basis in the first nine months of 2013. Associated Materials The building materials sector is home to this 67-year-old company, which did not specify a reason for withdrawing its planned IPO this April. Market weakness probably had at least something to do with it; on the same day it bagged its issue, three other stocks coming to market priced below their anticipated per-share ranges. Fundamentals might also have been a factor. Both the current form of the company and its immediate predecessor have generally been unprofitable since 2009, and revenue has dropped in recent times. This is the sort of combination that gives investors pause. Regardless, a trio of busy financials -- Goldman Sachs (GS), Barclays and UBS Investment Bank -- were set to lead-underwrite the issue, which was planned to raise up to $100 million on the Nasdaq or New York Stock Exchange.

Jeff Chiu/AP So far, 2014 has been a high-scoring year for initial public stock offerings. The first quarter saw more IPO activity than any other initial quarter since 2000, with 64 companies listing on various U.S. exchanges raising a collective $10.6 billion. That's more than double the number of IPOs that took place in the first quarter of 2013. This is directly related to the health of the overall stock market. Generally speaking, the better shares are performing, the higher the chance of an issuer being successful on IPO day. After all, who's eager to buy anything when the market's in the doldrums? Yet even in a good environment for IPOs, companies occasionally get the jitters and withdraw their listings. Sometimes this is due to the overall atmosphere on the market; sometimes it's because of difficulties with the issuing company itself; sometimes it's both. Whatever the reason(s), the notable examples below scampered away before they could become publicly traded entities. Square One of the top anticipated IPOs of 2014 was for this cutting-edge e-commerce company, which pioneered the use of smartphone and tablet payment card readers. Then there's Square's impeccable geek credentials, thanks in no small part to its founder-CEO Jack Dorsey, who was one of the guiding lights behind Twitter (TWTR). That, apparently, wasn't enough to bring it to market. In late February, media reports had it that the company postponed its planned IPO indefinitely. It seems that it's burning through cash very quickly and doesn't have enough revenue to cover this. Instead of listing on an exchange, the firm is reportedly looking for a deep-pocketed suitor and has allegedly held discussions with Google (GOOG), Apple (AAPL) and eBay (EBAY), and possibly even one of its investors, Visa (V), regarding a potential buyout. Square denies it has been in acquisition talks. Trustwave Holdings Another nonstarter in the tech IPO space was Trustwave, which provides on-demand data security solutions. After Target (TGT) suffered a large-scale breach of its credit card data last November, both the retailer and Trustwave were sued by a pair of regional banks that claimed they suffered financial damages from the incident. Trustwave claimed that it didn't outsource data security to Target (it's hard to tell -- such arrangements are usually confidential). Nevertheless, the lawsuit attracted the wrong kind of publicity before the banks dropped it in April. Interestingly, Trustwave's cancellation of the IPO was its second; the first was a flotation planned for August 2011. This time, the company was to sell 6.25 million shares priced at $15 to $17 apiece on the Nasdaq. The underwriting syndicate was led by heavyweights Morgan Stanley (MS), JPMorgan Chase's (JPM) J.P. Morgan unit and Barclays (BCS) Capital. Sundance Energy Australia The world just can't get enough energy; oil and gas markets are thriving these days. Combine that with a strong market for IPOs, and you've got a bunch of new issues in the energy sector listing on stock markets. Sundance Energy Australia had planned to complement the extant listing on its native exchange by floating nearly 7.8 million American depository shares on the Nasdaq. The issue was slated for this past February and was to be lead-underwritten by Wells Fargo (WFC) Securities, Canaccord Genuity and UBS (UBS) Investment Bank. But in April the company pulled the issue due to market conditions. That's a shame, as Sundance likely would have attracted investor interest given that it has a presence in rich U.S. plays such as the Bakken formation in the Midwest. Although the company's net result hasn't always been positive, Sundance almost doubled its top line on a year-over-year basis in the first nine months of 2013. Associated Materials The building materials sector is home to this 67-year-old company, which did not specify a reason for withdrawing its planned IPO this April. Market weakness probably had at least something to do with it; on the same day it bagged its issue, three other stocks coming to market priced below their anticipated per-share ranges. Fundamentals might also have been a factor. Both the current form of the company and its immediate predecessor have generally been unprofitable since 2009, and revenue has dropped in recent times. This is the sort of combination that gives investors pause. Regardless, a trio of busy financials -- Goldman Sachs (GS), Barclays and UBS Investment Bank -- were set to lead-underwrite the issue, which was planned to raise up to $100 million on the Nasdaq or New York Stock Exchange.

) released its preliminary Q4 earnings. The company also announced that its board has approved a $275 million stock repurchase. The company is releasing its official results on February 27.

) released its preliminary Q4 earnings. The company also announced that its board has approved a $275 million stock repurchase. The company is releasing its official results on February 27. Scott Hanson

Scott Hanson  Associated Press

Associated Press

Achmad Ibrahim/APBlackBerry CEO John Chen WATERLOO, Ontario and TORONTO -- BlackBerry (BBRY) reported a smaller-than-expected quarterly loss Thursday as the smartphone company's cost cutting and other turnaround efforts started to pay off. Shares jumped more than 10 percent in early trade after BlackBerry burned through less cash than many expected and its gross profit margin rose from a year earlier. "The short trade is over in this name for now -- for now," said BGC analyst Colin Gillis. "They've got enough liquidity, [and] they've given us clear profitability targets." Excluding special items, the company drew down $255 million in cash in the period, significantly less than the $784 million it used in the fiscal fourth quarter. BlackBerry has been slashing costs and has more than halved its workforce over the last two years as part of a do-or-die attempt to turn its business around after losing ground to Apple's (AAPL) iPhone and Samsung Electronics devices that run on Google's (GOOG) Android system. Last year it forged a partnership with FIH Mobile, the Hong Kong-listed unit of Taiwanese electronics company Foxconn Technology, to help design, manufacture and sell some of its devices. As part of the deal it no longer pays the full upfront costs for parts used in its devices. Instead, Foxconn, the trading name of Hon Hai Precision Industry, takes a share of profits on each device in return for taking on the risk of inventory management. Gross profit margin rose to 46.7 percent in the fiscal first quarter to May 31, from 33.9 percent a year earlier. The Waterloo, Ontario-based company reported net income of $23 million, or 4 cents a share, compared with a loss of $84 million, or 16 cents, a year earlier. Excluding a one-time non-cash accounting gain and certain restructuring charges, the loss was $60 million, or 11 cents a share. Analysts, on average, had expected a loss of 25 cents a share, according to Thomson Reuters I/B/E/S. Quarterly revenue dropped to $966 million from $3.07 billion a year earlier. Cash rose to $3.1 billion from $2.7 billion on a sequential basis, helped by gains from the sale of real estate assets and a tax refund. -.

Achmad Ibrahim/APBlackBerry CEO John Chen WATERLOO, Ontario and TORONTO -- BlackBerry (BBRY) reported a smaller-than-expected quarterly loss Thursday as the smartphone company's cost cutting and other turnaround efforts started to pay off. Shares jumped more than 10 percent in early trade after BlackBerry burned through less cash than many expected and its gross profit margin rose from a year earlier. "The short trade is over in this name for now -- for now," said BGC analyst Colin Gillis. "They've got enough liquidity, [and] they've given us clear profitability targets." Excluding special items, the company drew down $255 million in cash in the period, significantly less than the $784 million it used in the fiscal fourth quarter. BlackBerry has been slashing costs and has more than halved its workforce over the last two years as part of a do-or-die attempt to turn its business around after losing ground to Apple's (AAPL) iPhone and Samsung Electronics devices that run on Google's (GOOG) Android system. Last year it forged a partnership with FIH Mobile, the Hong Kong-listed unit of Taiwanese electronics company Foxconn Technology, to help design, manufacture and sell some of its devices. As part of the deal it no longer pays the full upfront costs for parts used in its devices. Instead, Foxconn, the trading name of Hon Hai Precision Industry, takes a share of profits on each device in return for taking on the risk of inventory management. Gross profit margin rose to 46.7 percent in the fiscal first quarter to May 31, from 33.9 percent a year earlier. The Waterloo, Ontario-based company reported net income of $23 million, or 4 cents a share, compared with a loss of $84 million, or 16 cents, a year earlier. Excluding a one-time non-cash accounting gain and certain restructuring charges, the loss was $60 million, or 11 cents a share. Analysts, on average, had expected a loss of 25 cents a share, according to Thomson Reuters I/B/E/S. Quarterly revenue dropped to $966 million from $3.07 billion a year earlier. Cash rose to $3.1 billion from $2.7 billion on a sequential basis, helped by gains from the sale of real estate assets and a tax refund. -.  Getty Images For a lot of people, the end of the year is a time of celebration. Not just because of the holidays and family - but also for the big end-of-the-year bonus that gets paid out for all the work you've done over the last 12 months. More than half of all employers give out a year-end bonus that might be monetary in nature or come in the form of other benefits like gifts cards or employee gift registries. Monetary bonuses can differ in appearance too from direct paycheck compensation to 401(k) contributions. Some people refer to this type of bonus as a Christmas bonus. While bonuses have experienced a downward trend over the last few years due to the recession, the average bonus was about 1.3 months of salary in 2013, according to JobsDB.com. Wall Street Takes the Cake for Year-End Bonuses It's no secret that the biggest year-end bonuses go to those who work on Wall Street. These bonuses can run from a few thousand for a secretary to millions for higher-level management. In 2013, the average Wall Street bonus rose 15 percent to $164,530, according to The New York Times. That's still tame compared to the biggest bonuses paid out to Wall Street executives. The top three bonuses of 2013 - paid to Michael Farrell, Ian Cumming and Leslie Moonves - alone added up to around $84 million, according to Forbes. Farrell's bonus was earned on only a partial year of work. $29 million -– Michael Farrell, former CEO of Annaly Capital Management $27.5 million -– Ian Cumming, CEO of Leucadia National Corp. $27.5 million -– Leslie Moonves, CEO of CBS (CBS) While we can safely assume these people have a huge tax bill at the end of the year, you might be surprised to know that - whether you received one hundred thousand dollars or just a few hundred bucks - the tax rate on bonuses remains the same for most. How Your Bonus Gets Taxed The first thing you'll probably notice when receiving a bonus check is how much gets taken out in taxes. It's not complicated, and it is taxed under a different set of rules than your standard income is. Bonuses, commissions and prizes are all considered supplemental wages and are subject to a supplemental wage tax. If you have more than one million in supplemental wages for the year, your employer must withhold tax at the highest federal rate of 39.6 percent. If it's less than that amount, then it depends on how the wages are paid. If your bonus is not designated as a supplemental wage, taxes are withheld based on your W-4 form. However, if this income is noted separately, your employer must withhold 25 percent or combine your regular and supplemental earnings in one pay period and apply the regularly withholding rates. Note how this tax could differ from a graduated income tax, which is adjusted based on income bracket. Putting That Bonus to Work The most exciting part of getting a bonus is deciding how to spend it. Many financial planners like to use the 50-30-20 rule: 50 percent of your budget toward necessities (food, water, shelter, transportation etc.) and paying down debt, 30 for discretionary use, and 20 percent toward savings. Instant paydays are easy to celebrate and can provide an excuse for lavish spending, at least once a year; however, a more appropriate use of that bonus is to get yourself more organized financially. If you have debt, that bonus can wipe it out or at least reduce it substantially. You'll save money on interest payments over the long term and improve your credit score, as well, which will lead to even more savings moving forward. A good financial plan includes at least three to six months worth of emergency savings built up. If you haven't done that, you might consider funding an emergency account. You never know when the unexpected will happen and knowing that you're prepared take a lot of worry and stress out of unforeseen circumstances. The holiday season is also a period of budget busting, as the average shopper will spend $804.42 this year celebrating Christmas, Hanukkah or Kwanzaa, according to the National Retail Federation. Much of this spending will end up on credit cards, which could take shoppers several months to pay off, potentially at the detriment of their credit scores. Of course, working all year long and having nothing to show for it isn't a great reward system. If your finances are squared away, go ahead and splurge a little, as this could also be a good opportunity to indulge and fight off frugal fatigue. Take the family on vacation or buy something you know you'll enjoy. If you've made sure to put some of that bonus toward debt and savings to make financial progress, if needed, then you can spend the rest guilt free.

Getty Images For a lot of people, the end of the year is a time of celebration. Not just because of the holidays and family - but also for the big end-of-the-year bonus that gets paid out for all the work you've done over the last 12 months. More than half of all employers give out a year-end bonus that might be monetary in nature or come in the form of other benefits like gifts cards or employee gift registries. Monetary bonuses can differ in appearance too from direct paycheck compensation to 401(k) contributions. Some people refer to this type of bonus as a Christmas bonus. While bonuses have experienced a downward trend over the last few years due to the recession, the average bonus was about 1.3 months of salary in 2013, according to JobsDB.com. Wall Street Takes the Cake for Year-End Bonuses It's no secret that the biggest year-end bonuses go to those who work on Wall Street. These bonuses can run from a few thousand for a secretary to millions for higher-level management. In 2013, the average Wall Street bonus rose 15 percent to $164,530, according to The New York Times. That's still tame compared to the biggest bonuses paid out to Wall Street executives. The top three bonuses of 2013 - paid to Michael Farrell, Ian Cumming and Leslie Moonves - alone added up to around $84 million, according to Forbes. Farrell's bonus was earned on only a partial year of work. $29 million -– Michael Farrell, former CEO of Annaly Capital Management $27.5 million -– Ian Cumming, CEO of Leucadia National Corp. $27.5 million -– Leslie Moonves, CEO of CBS (CBS) While we can safely assume these people have a huge tax bill at the end of the year, you might be surprised to know that - whether you received one hundred thousand dollars or just a few hundred bucks - the tax rate on bonuses remains the same for most. How Your Bonus Gets Taxed The first thing you'll probably notice when receiving a bonus check is how much gets taken out in taxes. It's not complicated, and it is taxed under a different set of rules than your standard income is. Bonuses, commissions and prizes are all considered supplemental wages and are subject to a supplemental wage tax. If you have more than one million in supplemental wages for the year, your employer must withhold tax at the highest federal rate of 39.6 percent. If it's less than that amount, then it depends on how the wages are paid. If your bonus is not designated as a supplemental wage, taxes are withheld based on your W-4 form. However, if this income is noted separately, your employer must withhold 25 percent or combine your regular and supplemental earnings in one pay period and apply the regularly withholding rates. Note how this tax could differ from a graduated income tax, which is adjusted based on income bracket. Putting That Bonus to Work The most exciting part of getting a bonus is deciding how to spend it. Many financial planners like to use the 50-30-20 rule: 50 percent of your budget toward necessities (food, water, shelter, transportation etc.) and paying down debt, 30 for discretionary use, and 20 percent toward savings. Instant paydays are easy to celebrate and can provide an excuse for lavish spending, at least once a year; however, a more appropriate use of that bonus is to get yourself more organized financially. If you have debt, that bonus can wipe it out or at least reduce it substantially. You'll save money on interest payments over the long term and improve your credit score, as well, which will lead to even more savings moving forward. A good financial plan includes at least three to six months worth of emergency savings built up. If you haven't done that, you might consider funding an emergency account. You never know when the unexpected will happen and knowing that you're prepared take a lot of worry and stress out of unforeseen circumstances. The holiday season is also a period of budget busting, as the average shopper will spend $804.42 this year celebrating Christmas, Hanukkah or Kwanzaa, according to the National Retail Federation. Much of this spending will end up on credit cards, which could take shoppers several months to pay off, potentially at the detriment of their credit scores. Of course, working all year long and having nothing to show for it isn't a great reward system. If your finances are squared away, go ahead and splurge a little, as this could also be a good opportunity to indulge and fight off frugal fatigue. Take the family on vacation or buy something you know you'll enjoy. If you've made sure to put some of that bonus toward debt and savings to make financial progress, if needed, then you can spend the rest guilt free.

The FTC says AT&T reduced speeds for customers with unlimited data plans by nearly 90% in some cases. NEW YORK (CNNMoney) AT&T is back in the government's crosshairs.

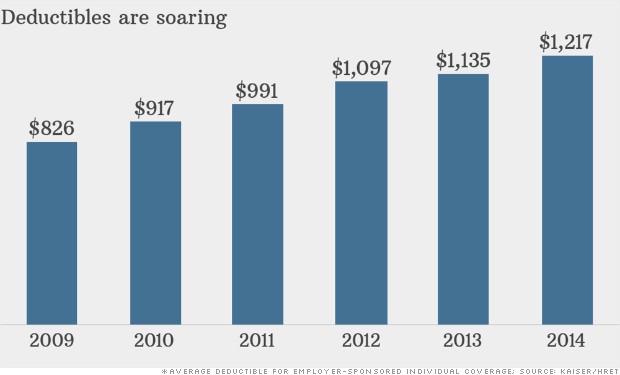

The FTC says AT&T reduced speeds for customers with unlimited data plans by nearly 90% in some cases. NEW YORK (CNNMoney) AT&T is back in the government's crosshairs.  Health insurance: 5 basic questions to ask NEW YORK (CNNMoney) Got health insurance at work? You may still have to shell out thousands of dollars before it kicks in.

Health insurance: 5 basic questions to ask NEW YORK (CNNMoney) Got health insurance at work? You may still have to shell out thousands of dollars before it kicks in.

Medical care has become more costly for the Vance family under a high-deductible plan.

Medical care has become more costly for the Vance family under a high-deductible plan.